- says product loading ongoing

The Nigerian National Petroleum Company Limited (NNPC) has affirmed that the renovated Port Harcourt refinery is fully operational.

The state-owned oil company clarified that preparations for loading operations were ongoing as of Saturday.

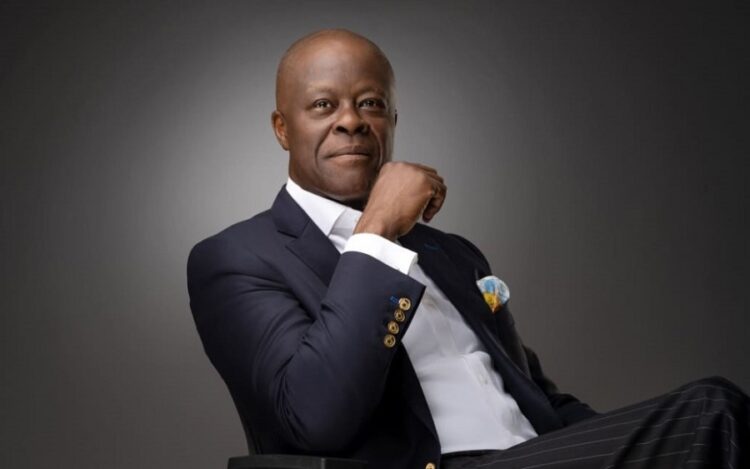

This clarification was made in a statement by Olufemi Soneye, the NNPC’s Chief Corporate Communications Officer, on Saturday.

Soneye was responding to reports suggesting that the refinery had halted loading petroleum products just one month after its reopening.

He confirmed that the refinery is fully functional, with a recent verification by former NNPC Group Managing Directors.

An earlier report by Saturday Punch said that less than a month after the Port Harcourt Refining Company appeared to have resumed production, the facility had stopped working.

Reacting, Soneye said preparation for today’s loading was ongoing at the time of sending out the statement.

“The attention of the Nigerian National Petroleum Company Limited has been drawn to reports in a section of the media alleging that the Old Port Harcourt Refinery which was re-streamed two months ago has been shut down.

“We wish to clarify that such reports are totally false as the refinery is fully operational as verified a few days ago by former Group Managing Directors of NNPC.

“Preparation for the day’s loading operation is currently ongoing,” he said in the statement.

He urged members of the public to disregard the report saying the malicious reports were the work of individuals attempting to create artificial scarcity and exploit Nigerians.

“Members of the public are advised to discountenance such reports as they are the figments of the imagination of those who want to create artificial scarcity and rip-off Nigerians,” he stressed.

Olatunji Grace, a social media user with the handle @Tunjigrace, expressed her frustration, questioning the intentions of those who wish for things to go wrong in Nigeria.

She criticised individuals who discredit positive developments, stating, “Who are these people?

Does any other nation have such unfortunate citizens who pray for failure?”

She also expressed disappointment in a report by Punch Newspaper, describing it as “devilish and stupid journalism” that hides behind the guise of a “report.”

Another user, Patrick @Williamskane4, accused news media organisations of working with opposition political parties to spread fake news and misinformation.

He stated, “In collaboration with some opposition political parties, they spread lies, making propaganda their trade.”

Meanwhile, another user, Sarki @Waspapping_, defended the Old Port Harcourt Refinery’s operations, stating that the refinery is fully functional.

He questioned why some individuals and media outlets were spreading false narratives about shortages, claiming they aimed to exploit Nigerians.

Sarki emphasised that such misinformation benefits those who profit from scarcity and high prices and urged Nigerians to see through the lies and support local production efforts.

For decades, efforts to revive the Port Harcourt Refining Company (PHRC) seemed insurmountable. However, under Mele Kyari’s leadership, the once-elusive goal has been realised, signalling a critical step toward achieving energy self-sufficiency. This success is not only a milestone for the NNPCL but a testament to Kyari’s resolve to transform Nigeria’s energy landscape.

The Port Harcourt Refinery Company in Eleme is a sprawling facility divided into a 60,000-barrel-per-day-old refinery, and a new one capable of refining 150,000 barrels per day. The old refinery, operational since 1965, is Nigeria’s first refinery and had remained idle since 1990 when the newer unit became the primary production hub.

After over 30 years of dormancy, the old Port Harcourt refinery, which has a unique configuration where one barrel of crude oil yields a maximum of 23–24 per cent gasoline, was recently reopened by the NNPC Limited amid shock by forces against the revival of the country’s four refineries.

After the $1.5 billion approved by the Federal Government in 2021 for the comprehensive rehabilitation of the refinery had been judiciously spent, the NNPCL under Kyari’s sound leadership, reopened the Old Port Harcourt Refinery on Tuesday, November 26, 2024.

Today, the old Port Harcourt refinery is currently producing straight-run gasoline (Naphtha) blended into 1.4 million liters of PMS daily; 900,000 liters of kerosene; 1.5 million liters of Automotive Gas Oil (Diesel); 2.1 million liters of Low Pour Fuel Oil (LPFO), and additional volumes of Liquefied Petroleum Gas (LPG), also known as cooking gas.

Attempts by sceptics to rubbish the achievement recorded with the 60,000-barrel-per-day Port Harcourt refinery had been roundly repudiated by the NNPCL, workers at the refinery, experts, and delegates from the Presidency, Nigeria Labour Congress, Trade Union Congress, Petroleum and Natural Gas Senior Staff Association of Nigeria, and Nigeria Union of Petroleum and Natural Gas Workers.

Credit: The Punch

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago