BIG STORY

NELFUND Launches Pilot Phase Of Nigeria’s Student Loan Scheme

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2024/05/resize1716544787891.jpg&description=NELFUND Launches Pilot Phase Of Nigeria’s Student Loan Scheme', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2024/05/resize1716544787891.jpg&description=NELFUND Launches Pilot Phase Of Nigeria’s Student Loan Scheme', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY2 days ago

BIG STORY2 days agoBREAKING: Again, Gunmen Attack Kwara Community, Abduct Pregnant Woman, Nursing Mothers, Children

-

BIG STORY3 days ago

BIG STORY3 days ago47km Section 1 Of Lagos-Calabar Coastal Highway Ready For Public Use Dec 12 — Works Minister Dave Umahi

-

BIG STORY16 hours ago

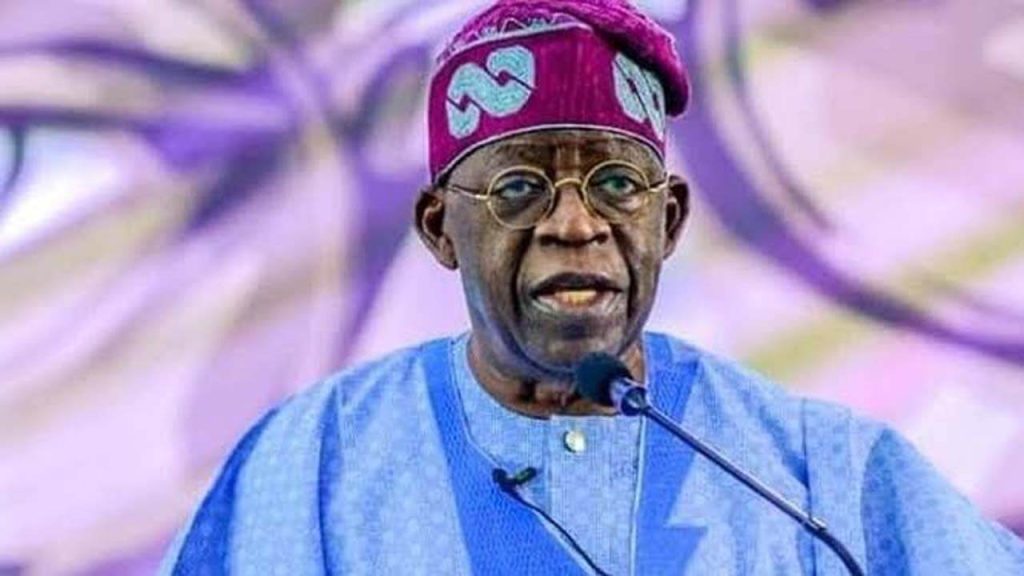

BIG STORY16 hours agoBREAKING: Tinubu Nominates 3 Non-Career Ambassadors

-

BIG STORY2 days ago

BIG STORY2 days agoI Was So Angry I Felt Like Hitting Obasanjo With Microphone At My Birthday Party — Fayose

-

BIG STORY3 days ago

BIG STORY3 days agoIgbos Should Stop Being Emotional Over Nnamdi Kanu’s Conviction, IPOB Killed Over 30,000 People in The Southeast — Orji Kalu

-

BIG STORY23 hours ago

BIG STORY23 hours ago2026 Appropriation Bill: Obasa Says Budget Fundamental To Sustaining Lagos’ Position As Africa’s Leading Economic Hub

-

BIG STORY3 days ago

BIG STORY3 days agoPaystack Sacks Co-Founder Ezra Olubi Amid Sexual Misconduct Allegations

-

BIG STORY2 days ago

BIG STORY2 days agoOgun To Prosecute DJ Chicken Over Multiple Road Crashes