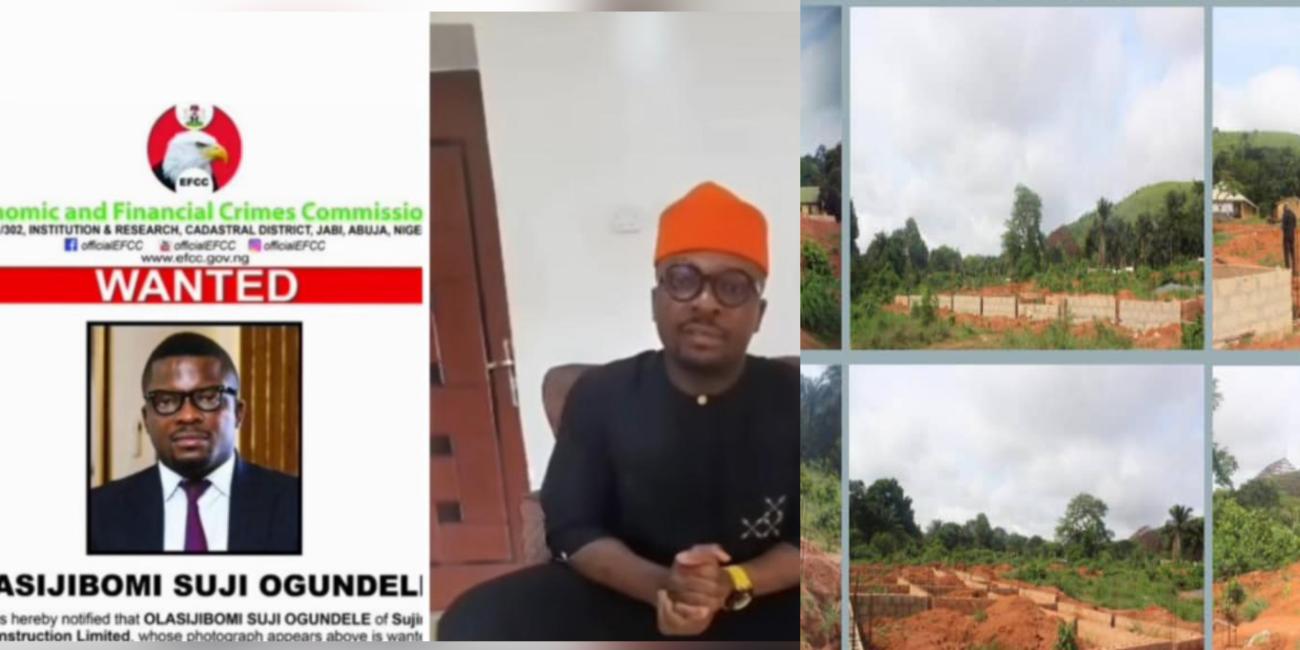

- all projects never left foundation stage

The Enugu State government has accused the CEO of Sujimoto Luxury Construction Limited, Olasijibomi Ogundele, of defrauding the state of nearly N6bn, noting that Ogundele vanished into thin air after he was paid the said sum for the construction of 22 Smart Green Schools in different parts of the state.

The government also accused Ogundele of premeditated fraud, explaining that while he presented a bond issued by Jaiz Bank to secure the contract, he used the company’s Zenith Bank account registered with the state’s Ministry of Works and Infrastructure to receive the said payment, making it impossible for the state to hold Jaiz Bank liable.

The statement said, “For the avoidance of doubt, on July 2, 2024, the Enugu State Government awarded a contract in the sum of N11,457,930,950.52 to Sujimoto Luxury Construction Ltd for the construction of 22 Smart Schools (buildings only) in six months starting from the date of the acceptance of the award.

“The Enugu State Government paid the sum of N5,762,565,475.25, representing 50 per cent of the contract sum, in order to fast-track the projects at all the sites.

“Rather than play to the rules of the contract to deliver quality projects for furnishing and equipping ahead of September 2025 school resumption, in line with the priority placed on the Smart Green Schools initiative by the government, Mr. Ogundele resorted to shoddy jobs and the use of inexperienced workers and quack engineers. None of his sites met the structural integrity of the projects as specified in the structural drawing.

“Worse still, he vanished into thin air with the money. All efforts made by the government to get him to a roundtable to discuss the quality and progress of work proved abortive. He equally refused to attend the periodic projects briefing organised by the state government for all contractors or take numerous calls and messages put across to him. In fact, he practically abandoned the sites, leaving the Enugu State Government with no other choice than to petition the Economic and Financial Crimes Commission (EFCC) to recover the funds paid to him.

“A joint team of officers of the Enugu State Ministry of Works and Infrastructure and the EFCC visited the 22 sites to evaluate the progress of work on May 8 and 9, 2025, where it was clearly established that there had been minimal to no significant work done at the said sites one year after the contract award. In some cases, he fraudulently did not do excavation for all the blocks in site.

“It is also on record that he has not shown up at the sites or made himself available to either the state government or the law enforcement agencies even after those site visits.

“It is also pertinent to state that it was discovered in the course of investigation that whereas he presented a bond from Jaiz Bank, he used Sujimoto Luxury Construction Limited’s Zenith Bank account number 1312731196 to receive the said payment and draw down the fund without deploying it to the projects. This clearly shows a premeditated intent to defraud the state ab initio.

“The government has since retaken and handed over the sites to new firms, who has no choice than to start the construction afresh. Tremendous progress has been made to keep the determination of the Mbah Administration to migrate Enugu children to Smart Green Schools by September on track.

“Nigerians should therefore disregard his theatrics and crocodile tears, as Enugu State Government is determined to and will surely recover every penny of Ndi Enugu fraudulently obtained by Mr. Olasijibomi Ogundele (Sujimoto).”

The Enugu State Government’s statement was accompanied with pictures of the project sites as abandoned by Sujimoto, which were taken by the joint team of officials of the state and operatives of the EFCC during the May 8 and 9 site visits. The pictures clearly showed that the project sites were mostly at the levels of foundation and DPC, with a few at the stage of block work.

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY18 hours ago

BIG STORY18 hours ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY3 days ago

BIG STORY3 days ago