- As NDLEA intercepts illicit drugs in wedding gown; nabs 400-level varsity student in Bayelsa, cripple in Edo, ex-convict in Adamawa, notorious dealer in Ondo; seizes 1.2 tons of skunk in Kaduna.

A widower, Ariyibi Ahmed Olaseinde and a divorcee, Akanbi Silifat Tunrayo who were going for lesser hajj in Saudi Arabia have been arrested by operatives of the National Drug Law Enforcement Agency, NDLEA, at the Murtala Muhammed International Airport, MMIA Ikeja Lagos for attempting to export 14.4 kilograms of cocaine concealed in lace and ankara fabrics.

Ariyibi was intercepted on Thursday 20th April at the screening point of MMIA Terminal 2 during outward clearance of Qatar Airways passengers travelling from Lagos via Doha to Medina, Saudi Arabia. When his carry-on bag was checked, four sets of white lace material with linings of substance that tested positive to Cocaine weighing 11.50kg were discovered.

The suspect who claimed to be a widower and an advertising practitioner said his original plan was to ingest the drugs but had to change his mind after failed attempts to swallow bitter cola, which he was using to practice the process. He is expected to be paid One Million, Eight Hundred Thousand Naira (N1,800,000) upon successful delivery of the consignment in Medina, Saudi Arabia.

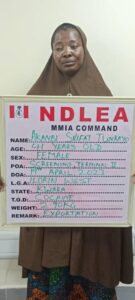

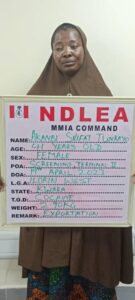

The previous day, Wednesday 19th April, NDLEA officers at the Terminal 2 of the airport also arrested Mrs. Silifat Tunrayo Akanbi with 2.90kg cocaine during outward clearance of Qatar Airways passengers from Lagos via Doha to Jedda, Saudi Arabia. A search of her hand luggage led to the discovery of six sheets of cocaine weighing 2.90kg concealed in ankara fabrics.

Preliminary investigation revealed that the suspect is a divorcee and a trader who used to hawk cloths around Awoyaya area of Ajah, Lagos. Based on information in her statement, a follow up operation that lasted through the night into the early hours of Thursday 20th April was carried out, during which the person who recruited her, Alhaji Adebayo Adeola Wasiu was arrested at No 28, Olateju Street, Mushin, Lagos. Adebayo is the managing director of B&T Travel Agency.

In the same vein, NDLEA officers attached to courier companies have intercepted two drug consignments consisting of ecstasy and skunk going to United Arab Emirate. While the pills of ecstasy were concealed in a gold colour wedding gown, the skunk was hidden in a micro controller.

This is even as a 400-level Marine Engineering student at the Niger Delta University, Amassoma, Bayelsa state, Kelvin Ogenedoro has been arrested for dealing in 600grams of skunk. He was nabbed at the universitys gate in a follow up operation following the interception of the consignment in a commercial bus along Tombia-Amassoma road.

In Adamawa state, a notorious drug dealer, Sunday Ishaku Emzor (aka Lalas) who was convicted and sentenced to 15 years imprisonment in 2010 for drug offences, was on Thursday 20th April arrested for drug dealing. He was arrested at Hayin Gada, Imburu Numan LGA where he went to supply 1.650kg cannabis to an undercover operative. His Yellow Press Cub motorcycle used for supplying illicit drugs and a cash of N78,120 suspected to be proceed of the illegal business were recovered from him at the point of arrest.

On the same day in Kaduna, operatives acting on credible intelligence intercepted a truck conveying 110 bags and 200 compressed blocks of cannabis sativa weighing 1.223 tons (1,223kg) in Zaria while the truck driver, Adekunle Olanrewaju, 32, and his assistant, Tunde Jamiu, 20, were arrested.

In Edo State, a 42-year-old cripple, Lucky Aigberenmolen trading in illicit drugs on his wheelchair was arrested in a raid of drug joints in parts of the state. While Lucky was nabbed at Ekpoma, Esan West LGA with 1.3kg of Cannabis Sativa and 10 litres of Monkey Tail, another suspect, Mary David,46, was arrested at Ugbegun, Esan Central LGA with four litres of Monkey Tail and Osagiede Stephanie, 19, at Ekpoma, with various quantities of Colorado, Methamphetamine, and Molly. A 50kg cannabis stored in a bush ready for distribution was also recovered in Irrua area of the state.

While two suspects: Adeshina Olalekan and Christopher Joel, were arrested at Lektop hotel, Igbeba, Ijebu Ode, Ogun State, with 39 litres of Skuchies, as well as various quantities of tramadol, and rophynol, operatives in Imo State intercepted a female suspect, Ijeoma Anyiam Loreza, 40, at Orogwe, Owerri North with 70 blocks of Cannabis Sativa weighing 30kg.

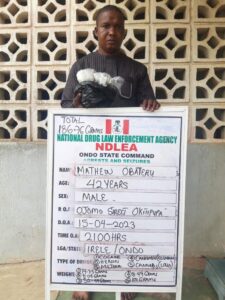

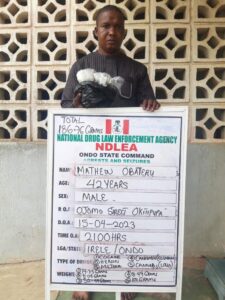

A notorious drug dealer in Okitipupa area of Ondo state, Mathew Obateru, 42, has also been taken into custody after different quantities of Cocaine, Heroin, Methamphetamine, Colorado and Loud were recovered from him. In Taraba, a suspect, Mohammed Usman was arrested on Monday 17th April in connection with the seizure of 10,009 pills of tramadol.

While commending the officers and men of the MMIA, Directorate of Operations and General Investigation, DOGI, Bayelsa, Adamawa, Kaduna, Edo, Ogun, Imo, Ondo and Taraba Commands of the Agency for the excellent job done in the past week, Chairman/Chief Executive Officer of NDLEA, Brig. Gen. Mohamed Buba Marwa (Retd) charged them and their compatriots across the country to continue to raise the bar of professionalism in the daily discharge of their responsibilities.

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY21 hours ago

BIG STORY21 hours ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago