In a year filled with trials and triumphs, these individuals and organizations have risen above challenges to embody resilience, innovation, and exceptional leadership. From the unbreakable spirit of the Man of the Year to the groundbreaking strides of Dangote Refinery, the transformative efforts of Stella Okotete, and the impactful reforms led by Olubunmi Tunji-Ojo, these stories inspire hope and progress for a brighter Nigeria.

1. Meet the Man of the Year

The Man of the Year is no ordinary person. He’s a Nigerian who has lived through the realities of 2024—one of the toughest years yet.

He is the man who has endured the hardship of a nation in flux. From waking up each day to face the high cost of fuel to navigating skyrocketing food prices, he’s felt the weight of every naira spent. Insecurity loomed over his daily life, yet he carried on with courage, protecting what mattered most.

Through it all, this man refused to break. His resilience, grit, and determination to keep moving forward in the face of overwhelming odds set him apart. He is not celebrated for wealth or fame but for his strength, perseverance, and the hope he carries in his heart for a better tomorrow.

The Man of the Year is a symbol of every Nigerian who has faced the same struggles, stood firm, and chosen to believe in a brighter future. His story is your story—one of survival, strength, and the unbreakable spirit of Naija.

Here’s to the Man of the Year. He is proof that no matter how hard the times, resilience will always shine through.

2. Young Person of the Year: Stella Erhuwuoghene Okotete

Stella Okotete, Executive Director of the Nigerian Export-Import Bank (NEXIM), stands out as a trailblazer promoting youth and women’s participation in business, governance, and politics. A visionary leader, she spearheads innovative initiatives at NEXIM, including the Women and Youth Export Development Facility, which provides low-interest loans, and the Nigerian Export-Import Bank Academy (NEXA), a certified digital platform for export-import education.

With degrees from Benson Idahosa University and NOUN, alongside certifications from global institutions such as Harvard, Oxford, and Columbia Business School, Okotete has held significant political roles, including secretary of the APC Election Planning and Monitoring Committee in 2023. Her contributions to public service include serving as Special Assistant on MDGs for Delta State, where she aligned policies with sustainable development goals and implemented impactful programs in education, healthcare, and poverty alleviation.

As co-founder of the E’Girls Foundation, she has championed girl-child rights and human capacity development since 2000. Her work has also led to groundbreaking efforts like outlawing female circumcision in Ughelli North and driving school enrollment through the “War Against Loitering and Hawking During School Hours” initiative.

Committed to empowering women in governance, she developed a strategy to train 20 million women for public office and conceptualized the Progressive Women Trust Fund, fostering financial support for female leaders. Okotete’s relentless dedication to service, innovation, and empowerment makes her a standout leader transforming Nigeria’s socio-economic landscape.

3. Nigerian company of the year

Dangote Refinery

The Dangote Refinery is a game-changer for Nigeria’s oil industry. Located in the Lekki Free Trade Zone, Lagos, it’s the largest single-train refinery in the world, with a capacity to process 650,000 barrels of crude oil per day.

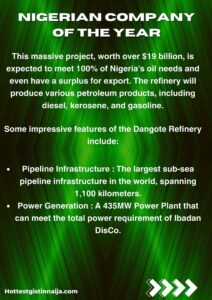

This massive project, worth over $19 billion, is expected to meet 100% of Nigeria’s oil needs and even have a surplus for export. The refinery will produce various petroleum products, including diesel, kerosene, and gasoline.

Some impressive features of the Dangote Refinery include:

– *Pipeline Infrastructure*: The largest sub-sea pipeline infrastructure in the world, spanning 1,100 kilometers.

– *Power Generation*: A 435MW Power Plant that can meet the total power requirement of Ibadan DisCo.

– *Job Creation*: The refinery is expected to provide 135,000 permanent jobs in the region.

The refinery began production in January 2024, starting with diesel fuel and aviation fuel. With its advanced technology and massive capacity, the Dangote Refinery is set to revolutionize Nigeria’s oil industry and boost the country’s economy.

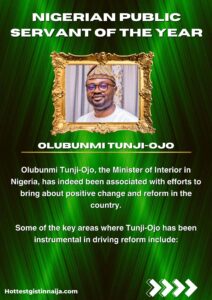

4. Nigerian public servant of the year

Olubunmi Tunji-Ojo, the Minister of Interior in Nigeria, has indeed been associated with efforts to bring about positive change and reform in the country.

Some of the key areas where Tunji-Ojo has been instrumental in driving reform include:

1. *Prison Reform*: Tunji-Ojo has been advocating for prison reform, aiming to improve the living conditions and rehabilitation programs for inmates.

2. *Immigration Reform*: He has been working to modernize Nigeria’s immigration system, making it more efficient and effective in managing the country’s borders.

3. *Disaster Management*: Tunji-Ojo has been instrumental in strengthening Nigeria’s disaster management capabilities, ensuring that the country is better prepared to respond to natural disasters and emergencies.

4. *Internal Security*: He has been working to enhance internal security in Nigeria, focusing on community policing and intelligence-driven law enforcement.

These efforts demonstrate Tunji-Ojo’s commitment to driving positive change and reform in Nigeria, particularly in the areas of justice, security, and humanitarian response.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY7 hours ago

BIG STORY7 hours ago