BIG STORY

Guaranty Trust Bank UK Reaches Settlement With The FCA In Connection With Historical AML Controls

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2023/01/1646417407205blob-1-1000x600.png&description=Guaranty Trust Bank UK Reaches Settlement With The FCA In Connection With Historical AML Controls', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2023/01/1646417407205blob-1-1000x600.png&description=Guaranty Trust Bank UK Reaches Settlement With The FCA In Connection With Historical AML Controls', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY4 days ago

BIG STORY4 days agoFG Proposes 40% Salary Increase For Lecturers As ASUU Prepares For Fresh Negotiations

-

BIG STORY3 days ago

BIG STORY3 days agoAbductions Surge: Northern Governors Demand Six Months Mining Suspension, Unveil N228bn Security Fund

-

BIG STORY3 days ago

BIG STORY3 days agoBREAKING: Defence Minister Badaru Resigns, Cites Health Reasons

-

BIG STORY4 days ago

BIG STORY4 days ago‘Terrorism Took Root On Your Watch’, Presidency Replies Obasanjo

-

BIG STORY3 days ago

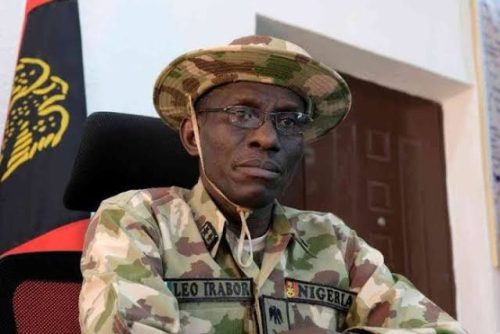

BIG STORY3 days agoIt’s Impossible For Repentant Boko Haram Members To Join Military – Ex-CDS Irabor

-

BIG STORY5 days ago

BIG STORY5 days agoFour Killed, 10 Injured In Shooting At Child’s Birthday Party In US

-

BIG STORY3 days ago

BIG STORY3 days agoOgun CP Confirms Abduction Of Six Real Estate Workers In Obafemi-Owode

-

BIG STORY4 days ago

BIG STORY4 days agoI Will Not Be Running Mate To Anybody In ADC, I Want To Be President In 2027 —– Amaechi