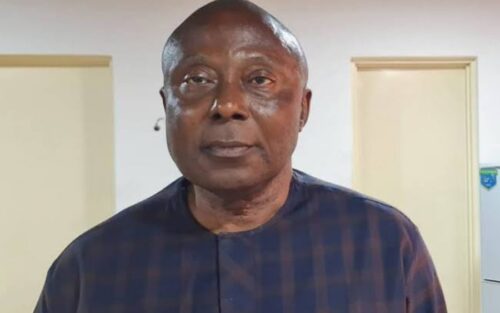

Anamekwe Nwabuoku, a former acting Accountant-General of the Federation, begged Justice James Omotoso of the Federal High Court in Abuja on Wednesday to grant him further time to complete the reimbursement of the public funds that he and his co-defendant are accused of embezzling.

Nwabuoku and Felix Nweke, his co-defendant, are accused of 11 counts of money laundering totaling N1.6 billion.

Economic and Financial Crimes Commission (EFCC) is the prosecuting authority for them.

The defendants were accused of committing to the act while Nwabuoku served as the Director of Finance and Accounts in the Ministry of Defence between 2019 and 2021.

While Nwabuoku is the first defendant, Nweke is the second defendant in the charge marked FHC/ABJ/CR/240/24 dated May 20 and filed on May 27 by EFCC counsel, Ekele Iheanacho.

Nwabuoku was appointed acting AGoF on May 20, 2022, under ex-President Muhammadu Buhari after Ahmed Idris was suspended as AGF over alleged N80bn fraud.

He was, however, removed in July 2022, a few weeks after assuming office.

When the matter was called on Wednesday, the defendants prayed the court to halt their arraignment until another date to perfect the refund.

Nweke’s lawyer, Emeka Onyeaka, informed the court that there was a new development in the case.

He told the court that his client had taken steps towards settling the matter.

The lawyer said Nweke had made substantial refunds of the money traced to him by the anti-graft agency.

“The second defendant has taken steps, as there is a communication to the commission via-a-vs the alleged offences on making a refund.

“The commission is in receipt of the money and promised to communicate to us,” he said.

The defence counsel said upon being served with the charge, “We communicated with the commission and we were asked to tarry for their administrative procedure.”

He said since a substantial amount had been refunded, if his client was arraigned, such action would affect the trial.

He, therefore, prayed the court to grant them an adjournment to take further steps on the administrative procedure.

Maduakolam Igwe, who appeared for Nwabuoku, aligned with Onyeaka’s submission.

Igwe said his client had equally taken the same steps and that a substantial amount had been refunded.

“We have written to the commission on this. The first defendant has also made some refunds.

“May I adopt the submission of my learner friend to tidy up the administrative procedure,” he corroborated.

Responding, counsel who appeared for the EFCC, Ogechi Ujam, acknowledged that though the commission was in receipt of a proposal letter, she said, “No negotiation has been made, no settlement has been done and no agreement has been reached by parties.

“In the circumstances, we urge this honourable court to allow us to arraign the defendants.”

After hearing the parties out, Justice Omotosho adjourned till October 14 for arraignment.

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY16 hours ago

BIG STORY16 hours ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago