- The award was bestowed on FirstBank in recognition of the Bank’s role in promoting trade and investment endeavours across the continent.

- With its subsidiaries across the FirstBank Group, FirstBank has continued to play a leading role in boosting cross-border businesses, including trade and investment opportunities, essential to enhancing trade relations amongst countries.

- In 2021, the Bank launched its First Global Transfer (FGT) initiative, specifically designed to ensure safe, timely and improved efficiency in the transfer of funds across the network of FirstBank subsidiaries in Africa.

First Bank of Nigeria Limited, Nigeria’s premier banking institution and leading financial inclusion services provider, has won the Financial Institution of the Year Award at the African Export-Import Bank (Afreximbank) Pan African Business and Development Awards. The ceremony marked the 30th anniversary of Afreximbank as it hosted the inaugural Pan-African Business and Development Awards in association with the Business Council for Africa (BCA), in Accra, Ghana.

The award bestowed on FirstBank is in recognition of the Bank as an epitome of the Pan-African spirit through its leading role in promoting trade and investment across the continent which have been instrumental to strengthening the economic and multilateral business relationship across nations.

Amongst its role in facilitating transactions across borders, in 2021, the Bank launched its First Global Transfer (FGT) initiative, specifically designed to ensure safe, timely and improved efficiency in the transfer of funds across the network of FirstBank subsidiaries in Africa. The FGT is not restricted to FirstBank Group’s Customers alone but it is also open to every individual resident in the country the funds transfer is originating from.

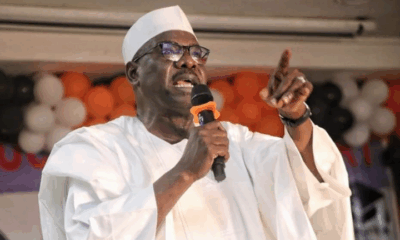

Speaking on the awards, Dr. Adesola Adeduntan, CEO, FirstBank said: “We thank the organisers of the event (Afreximbank, BCA) for the recognition as it reinforces our commitment to promoting trade, finance and investment opportunities across borders which have been instrumental to the continued growth and development of the continent and the world. On behalf of the Board and Management, this award is dedicated to all employees at the FirstBank Group for their diligence and hardwork as well as to our esteemed customers for their loyalty and patronage in over 129 years of existence’’ he concluded.

Also commenting on the awards, Prof. Benedict Oramah, President and Chairman of the Board, who has been at the Bank for over 29 years said: “Tonight we are recognising outstanding leaders and institutions. Having joined the Bank in 1994, I have been fortunate to have worked with many of them… At Afreximbank, contributing to Africa’s development is a lifetime vocation, as I know it is for all those that we have recognised tonight.”

In recognising these leaders and institutions, Arnold Ekpe, chair of the BCA and former Group CEO of Ecobank, said: “Too often our business leaders do not get the praise they deserve. Succeeding in business on the continent is not always easy, but it is rewarding and more importantly it is possible to build strong, profitable businesses that are globally competitive. Our winners tonight have demonstrated this.”

FirstBank has consistently been recognised by reputable global organisations for its steady outstanding performance and amongst the streak of recent wins is the award for Best Financial

Inclusion Service Provider Nigeria 2023 by Digital Banker Africa as well as Best Private Bank for

Sustainable Investing in Africa by Global Finance.

About FirstBank

First Bank of Nigeria Limited (FirstBank) is the premier Bank in West Africa and the leading financial inclusion services provider in Nigeria for 129 years.

With over 800 business locations and over 200,000 Banking Agents spread across 99% of the 774 Local Government Areas in Nigeria, FirstBank provides a comprehensive range of retail and corporate financial services to serve its over 41 million customer accounts (including digital wallets) in Nigeria and over 700,000 customer accounts outside the country. The Bank has an international presence with subsidiaries operating in 9 other countries. These subsidiaries are FirstBank (UK) Limited in London and Paris, FirstBank in The Gambia, FirstBank Sierra-Leone, FirstBank in the Republic of Congo, FBNBank in Ghana, FBNBank in Guinea, FBNBank in Senegal as well as a Representative Office in Beijing, China. The Bank is at the forefront of promoting digital banking in the country and has issued over 12 million cards, the first bank to achieve such a milestone. FirstBank’s cashless transaction drive extends to having more than 12 million people on its USSD Quick Banking service through the nationally renowned *894# Banking code and over 4.5 million people on the FirstMobile platform. It is, by far, the leader in the number of digital transactions per minute across multiple channels.

FirstBank’s commitment to Diversity is shown in its policies, partnerships and initiatives, such as its employees’ ratio of female to male (about 39%:61%; and 32% women in management) as well as the FirstBank Women Network, an initiative that seeks to address the gender gap and increase the participation of women at all levels within the organization. In addition, the Bank’s membership of the UN Women is an affirmation of a deliberate policy that is consistent with UN Women’s Women Empowerment’s Principles – Equal Opportunity, Inclusion, and Nondiscrimination.

Since its establishment in 1894, FirstBank has consistently built relationships with customers focusing on the fundamentals of good corporate governance, strong liquidity, optimised risk management and leadership. Over the years, the Bank has led the financing of private investment in infrastructure development in the Nigerian economy by playing key roles in the Federal Government’s privatisation and commercialisation schemes. With its global reach, FirstBank provides prospective investors wishing to explore the vast business opportunities available in Nigeria an internationally competitive world-class brand and a credible financial partner.

For six consecutive years (2011 – 2016), FirstBank was named “Most Valuable Bank Brand in Nigeria” by the globally renowned The Banker Magazine of the Financial Times Group and “Best Retail Bank in Nigeria” eight times in a row, 2011 – 2018, by the Asian Banker International Excellence in Retail Financial Services Awards.

Notably, in 2022, the Bank took a long stride on its growth trajectory with the Bank’s Viability and Long-Term Issuer Default Ratings upgraded to ‘B’ from ‘B-‘ (with Outlooks Stable) by Fitch, a leading global rating agency. This is an indication of the Bank’s strong internal capital generation and the corresponding recession of its risks to capitalisation. Fitch also upgraded the Bank’s National Long-Term Ratings to ‘A (nga)’ from ‘BBB (nga)’, to reflect its improved creditworthiness relative to that of other issuers in Nigeria. Furthermore, the Top 100 African Bank rankings 2022 released by The Banker Magazine revealed FirstBank’s ranking as number one in Nigeria in terms of Overall Performance, Profitability, Efficiency and Return on Risk.

Other laudable feats in 2022 include FirstBank’s international recognitions on major indices by Euromoney Market Leaders, an independent global assessment of the leading financial service providers where FirstBank was crowned:

Market Leader: (tier-1 recognition) in Corporate and Social Responsibility (CSR),

Market Leader: (tier -1 recognition) Environmental, Social and Governance (ESG),

Highly Regarded: in Corporate Banking and Digital Solutions,

Notable: in SME Banking.

Also, in 2022 International Finance Magazine named the Bank “Most Innovative Banking Product in Nigeria” and “Best Retail Bank in Nigeria”. FirstBank was also awarded “Best Corporate Banking Western Africa, 2022” and “Best CSR Bank Western Africa, 2022’’ by Global Banking and Finance Magazine. Other notable awards in FirstBank coffers include: “Best Bank in Nigeria” by Global Finance magazine – fifteen times in a row; “Best Private Bank in Nigeria-2021” awarded by Global Finance magazine; “Best Internet Banking Nigeria” and ‘’Best CSR Bank Africa’’ by International Business Magazine.

In 2023, FirstBank has received notable awards including “Best Private Bank for Sustainable Investing in Africa 2023” by Global Finance Awards; “Best Sustainable Bank in Nigeria 2023” by International Investors Awards; “Best Bespoke Banking Services in Nigeria 2023” by International Investors Awards; “Best Financial Inclusion Service Provider in Nigeria 2023” by Digital Banker Africa; and “African Bank of the Year” by African Leadership Magazine.

Our vision is ‘To be Africa’s Bank of first choice’ and our mission is ‘To remain true to our name by providing the best financial services possible. This commitment is anchored on our core values of EPIC – Entrepreneurship, Professionalism, Innovation and Customer-Centricity. Our strategic ambition is ‘To deliver accelerated growth in profitability through customer-led innovation and disciplined execution and our brand promise is always to deliver the ultimate “gold standard” of value and excellence to position You First in every respect.

Folake Ani-Mumuney

Group Head, Marketing & Corporate Communications

First Bank of Nigeria Limited