BIG STORY

Ethiopian Airlines Selected As Technical Partner, Core Investor Of Nigeria Air —- Report

-

BIG STORY4 days ago

BIG STORY4 days agoJnr. Pope: My Opinion On The Boat Crash That Claimed The Life Of Nollywood Talents By Seun Oloketuyi

-

BIG STORY4 days ago

BIG STORY4 days agoBobrisky Treated As Normal Male Inmate, No VIP Treatment — NCS Officials

-

BIG STORY2 days ago

BIG STORY2 days agoBREAKING: Court Grants Cubana Chief Priest N10m Bail In Naira Abuse Charge

-

BIG STORY4 days ago

BIG STORY4 days agoEFCC Grills Bank MDs, Others For Re-Looting Abacha Loot, Tampering With COVID-19 Funds, World Bank Loan

-

BIG STORY2 days ago

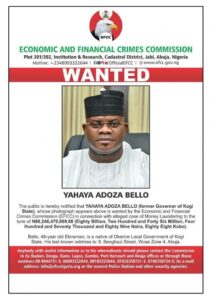

BIG STORY2 days agoBREAKING: EFCC Operatives Lay Siege To Yahaya Bello’s Abuja Mansion [PHOTOS]

-

BIG STORY2 days ago

BIG STORY2 days agoBREAKING: Court Upholds Ganduje’s Suspension As APC Chairman

-

BIG STORY2 days ago

BIG STORY2 days agoJUST IN: EFCC Files 3-Count Charge Against Cubana Chief Priest, To Be Arraigned Tomorrow For Naira Abuse

-

BIG STORY3 days ago

BIG STORY3 days agoDunamis Church Apologises Over Testimony Backlash As Abuja Testifier Meets Pastor Enenche, Wife