For the third consecutive year, Union Bank and its employees celebrated their Employee Volunteer Day (EV Day) with a series of targeted charitable donations and projects, aimed at improving the lives of Nigerians.

In line with the Bank’s efforts to drive sustainable impact and accelerate community development, EV Day is an employee-funded initiative that allows Union Bank and its employees the opportunity to give back to the community through various projects and activities that drive positive social change.

The latest installment of the initiative tagged “It Starts With U” involved a bottom-up approach where employees were encouraged to identify needs within their host communities that required timely attention after which they pooled resources to solve some of these identified problems in these areas.

Through the initiative, 20 impactful projects were executed and commissioned in different communities across three regions in the Nation. The projects which directly impacted over 253,000 people were centered around creating strategic development with a clear focus on Health & Wellness, Environmental Sanitation, and Education and Welfare in Nigeria.

Three projects were executed and commissioned In the South West region where Bolade Jegede, Regional Executive for South West, led the team of Union Bank Volunteers to the Island Maternity Hospital Lagos where they donated Medical equipment to the Neonatal unit to support existing facilities and help reduce neonatal mortality rate which is currently about 25% of the death toll for age 5 and below.

In the South East region, a total of eight projects were implemented across various states. Rosemary David-Etim, Regional Executive of the region led a team of over 100 employee volunteers to commission the renovated toilet facility at Comprehensive Secondary School Douglas Road Owerri, Imo State to support the governments’ efforts towards preventing pupils from contacting or spreading germs and infectious diseases which is now a national concern as only 10% of Nigerian schools have basic hygiene services, including toilets.

Nine projects were also commissioned in different locations across the Northern Region. The regional executive Fatai Baruwa, represented by Helen Okene, and other UBN Employee Volunteers carried out environmental sanitation in Dei-Dei building market Abuja and donated waste bins to the market traders to improve waste collection and disposal within the market.

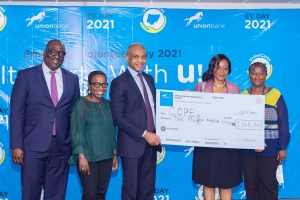

Other projects executed include; Donation of N2M to COPE towards breast and prostate cancer screening for at least 200 underprivileged men and women, donation of food supplies to various orphanage homes, donation of communal boreholes, school renovation, donation of traffic box to the traffic control unit of the police force.

Commenting on the initiative and expected project impact, Union Bank Chief Executive Officer Emeka Okonkwo, said “Union Bank is known for leading the charge for social impact. The theme for this EV Day tagged ‘It Starts with You’ is a necessary reminder of the role each of us must play as individuals in upholding and driving sustainable impact in the communities we serve. I am so inspired by Team Union and incredibly fortunate to work with colleagues that prioritizes our vision of community development and corporate citizenship”

Also commending the level of employee engagement, Chief Brand and Marketing Officer, Ogochukwu Ekezie-Ekaidem, said “Employee Volunteer Day is an initiative that is very close to my heart. Since 2019, we have executed projects in 30 locations across the country impacting over 300,000 lives. I am grateful to every employee that has donated to the successful execution of these projects.”

Introduced in 2019, EV Day reinforces Union Bank’s dedication to building a workforce that is conscious about giving back to the communities where they live and work. The first edition was a sanitation exercise carried out in 15 locations across the country with participation from over 1,200 Union Bank employees along with their family and friends. In 2020, the Bank and its Employees raised N10 million to provide the gift of water to over 15,000 Nigerians through the establishment of communal boreholes in six communities nationwide.

At Union Bank, Community Development remains one of our core focus and we will continue to provide support to the communities where they operate.

About Union Bank Plc:

Established in 1917 and listed on the Nigerian Stock Exchange in 1971, Union Bank of Nigeria Plc. is a household name and one of Nigeria’s long-standing and most respected financial institutions. The Bank is a trusted and recognizable brand, with an extensive network of over 300 branches across Nigeria.

In late 2012, a new Board of Directors and Executive Management team were appointed to Union Bank and in 2014 the Bank began executing a transformation program to re-establish it as a highly respected provider of quality financial services.

The Bank currently offers a variety of banking services to both individual and corporate clients including current, savings, and deposit account services, funds transfer, foreign currency domiciliation, loans, overdrafts, equipment leasing, and trade finance. The Bank also offers its customers convenient electronic banking channels and products including Online Banking, Mobile Banking, Debit Cards, ATMs, and POS Systems.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY18 hours ago

BIG STORY18 hours ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago