The Lagos State chapter of the Christian Association of Nigeria has endorsed the sacking of the Presiding Chaplain of the Chapel of Christ the Light, Alausa, Ikeja, Venerable Femi Taiwo.

The Chairman of CAN in the state, Apostle Alexander Bamgbola, said the sacking of Taiwo was done by the Governing Council of the chapel which hired him, adding that the council had the power to fire him.

However, questions on the circumstances surrounding the sacking, including the order for Taiwo, his wife and kids to vacate their official quarters within 24 hours, were parried by the cleric, who insisted that the matter should be allowed to rest.

Reporters were later asked to stop asking questions at the briefing, which was attended by leaders of CAN, representatives of the Christian Council of Nigeria and the African Church.

Recall that It was earlier reported that Taiwo’s sacking came after Bolanle, the wife of the state Governor, Mr. Akinwunmi Ambode, stormed out of an anointing service at the chapel on May 14.

Members of the church had told our correspondent that Bolanle was angry because she was not anointed first.

It was reported that some members of the church’s governing council were used by Bolanle, who felt embarrassed by the Sunday incident.

No query was issued to Taiwo on the matter before he was kicked out.

The outrage that trailed the report made the state government to change the venue of the Lagos at 50 thanksgiving service from the chapel to the banquet hall of the state house, Ikeja.

Taiwo’s leader at the African Church, Ifako Diocese, Rt. Rev. Michael Adeyemi, had, in an exclusive interview with our correspondent published last Saturday, described the action of Bolanle as ungodly and sacrilegious.

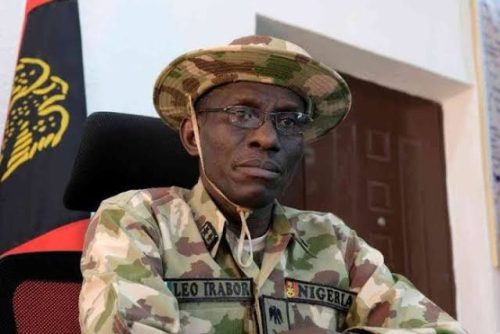

On Tuesday at a press briefing organised by the Lagos State Ministry of Home Affairs in the church, the CAN Chairman, Bamgbola, lauded the Lagos State Government for its achievements, adding that the governor and his wife had moved the state forward.

He said, “Over the past three weeks, while thanking our God and celebrating our jubilee in Lagos State, one very simple matter has been dominating the social media. This is the issue of the severance of the employment of Venerable Femi Taiwo, the former Presiding Chaplain of the chapel, by his employers.

“As a result of the unfortunate misunderstanding of the issue, caused by erroneous publications in the print and social media, we believe CAN, Lagos State, must make clarifications to educate the public on this matter.

“First, the CCTL was built by the state government for itself, its family of Christian employees and for the public at large.

“Second, the government created a standing legal constitution for the CCTL, which has guided the running of the chapel for years. According to that constitution, CCTL is under the leadership of a governing council, which reports to the Ministry of Home Affairs. All religious bodies in this state report to the ministry.

“The governing council of the chapel has the constitutional responsibility to recruit and terminate the appointment of two officers who run the chapel. The two officers are the presiding chaplain, who is the senior officer; and the chaplain, who is the deputy. The two are officers of the chapel and officers of the government of Lagos State.”

He said CAN had investigated the matter and discovered that the governing council sacked Taiwo within its constitutional powers.

“In particular is the accusation against our responsible and most revered First Lady, Deaconess Mrs. Bolanle Ambode, as being instrumental in the termination of the chaplain in the course of one anointing service.

“We wish to state clearly that this is far from the truth. Deaconess Mrs. Bolanle Ambode, as far as we know, is a true woman of God, who fears God and lives a godly life and whom it has pleased God to raise to be the First Lady at this time. We must be careful with God in all we do. The Bible says in Matthew 7:1, ‘Judge not, so that you are not judged.’” he added.

Drama ensued while Bamgbola and the other Christian leaders were fielding questions from journalists.

A reporter with Silverbird Television asked CAN chairman if Taiwo was actually asked to vacate his house within 24 hours.

He said, “This story would not have been of interest in anyway except that the reverend was thrown out of his residence in 24 hours. A lot of people consider that to be inhuman and unjust. Do you know exactly what happened? Was he thrown out of his residence? Was he given due notice to leave?”

Bamgbola, in his response said, “Thank you for your question. While all of us here have been talking, we have emphasised something: the matter is under control. The church and the government are handling it. Ok? That is the answer to your question.”

The response raised murmurs of discontent among the press as the Silverbird reporter insisted on a clearer response.

“I want to answer your question point blank. He was given notice! No, don’t shake your head. You asked if he was given notice and I said, yes, he was given notice,” Bamgbola said.

Another reporter asked if CAN had investigated the incident and what were its findings.

Bamgbola said the Christian body was still “finding the details.”