The recent collapse in global crude oil prices has further endangered Nigeria’s 2025 budget, as fuel marketers anticipate a potential drop in the cost of petroleum products.

Industry analysts told our correspondent that the plunge in crude oil prices, triggered by tariffs introduced by United States President, Donald Trump, is having mixed effects on Nigeria’s economy.

Although the Federal Government stands to lose significant revenue due to lower crude prices, consumers may benefit from reduced fuel costs.

Earlier reports had it that oil prices began to dip over the weekend, falling to $65 per barrel by Saturday.

By Monday, prices dropped further, with Brent at $64.16 and the US WTI at $60.73.

As reported by oilprice.com, a combination of Trump’s new tariffs, OPEC+’s poorly timed decision to fast-track the rollback of production cuts, and China’s retaliatory measures led to a $10-per-barrel slump in global oil prices, “with ICE Brent falling below $65 per barrel for the first time since August 2021.”

China’s countermeasures, including a 34 per cent tariff on all US goods starting April 10, have intensified an ongoing trade war, pushing investors to anticipate a recession.

Reuters revealed that countries worldwide are ready to strike back after Trump raised tariffs to unprecedented levels in over 100 years.

In addition to tariffs, another contributor to the declining oil prices was the Organisation of the Petroleum Exporting Countries and Allies’ decision to accelerate plans for increased output.

The group now intends to add 411,000 barrels per day to the market in May, a sharp rise from the previously agreed 135,000 bpd.

With crude prices dropping, the Federal Government is under pressure to find ways to address the revenue shortfall that could affect the 2025 budget.

According to The Punch, the government’s benchmark price for crude oil in the 2025 budget was set at $75 per barrel.

As Nigeria’s primary income source, crude oil’s price decline below the $75 benchmark—combined with the inability to increase daily production to two million barrels—jeopardizes the country’s revenue projections.

The budget was based on a production target of 2.06 million barrels per day at $75 per barrel. About N19.60tn—or 56 per cent of the anticipated N34.8tn revenue—is expected to come from oil, underscoring Nigeria’s dependency on the sector.

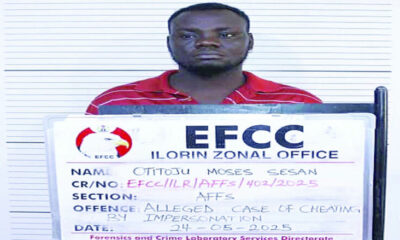

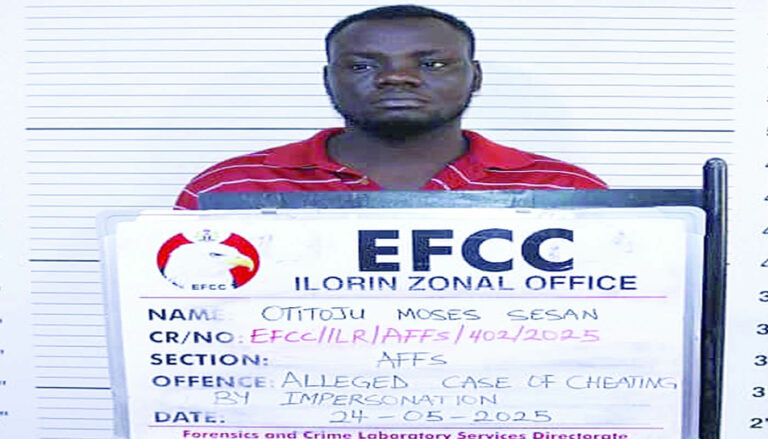

Clement Isong, Executive Secretary of the Major Energies Marketers Association of Nigeria, (speaking with The Punch) described the crude price fall as damaging to the economy, given the budget assumptions.

He remarked that the global situation is dire, more so than past crises.

He said, “We have had the market crash a few times, I think in 2008, and I can’t remember what the last one was, maybe 2014. But it has never been this bad. I’m talking about globally.

“Fortunately, this is man-made. It is because one person stood up and did something. So, it also means that if he can compromise, or they can work out some compromises, it might be reversed. But is there a negative impact on my country? Yes, as usual, it’s a negative and positive impact.”

He stressed that the sharp drop in crude oil price is harmful in light of the current benchmark.

“The extremely low price of crude oil at $65 per barrel is really bad based on the benchmark that was used for the budget for this year. So, if it should last, it means that the deficit would be even worse than what was anticipated. It’s really bad news for the expected revenues for the country,” Isong said.

He also warned that the lower price could affect investment levels due to high production costs.

“Hopefully, it will not impact too much on investments, because, as you recall, we have had insufficient investments in our upstream, leading to the decline in our crude oil output. Normally, in the world, when crude oil prices are high, those who invest in production bring out more money.

“Remember that Nigeria’s production cost is quite high because a lot of new production is deep offshore. So, because deep offshore is so expensive, you really need the cost of the crude to be as high as possible in order to generate the revenue that the country needs to fund its ambitious development programme. So, it’s both negative and positive.”

He added that while the production cost per barrel had dropped from $40, current crude prices remain unappealing.

“I hope we can push it down. But $66 per barrel is not very interesting. It’s not very good for us,” he stated.

Nevertheless, he acknowledged that the price slump may result in lower fuel costs at filling stations.

“With respect to prices at the pump, over time, I guess, they will go down. If the crash is continuous, fuel prices will go down, and that will provide some relief to commuters and transporters of goods. So, it has a dual impact,” he submitted.

Billy Gillis-Harry, President of the Petroleum Products Retail Outlet Owners Association of Nigeria, noted that the crash will bring mixed consequences for the economy.

He pointed out Nigeria’s over-reliance on oil revenue as a vulnerability, warning that falling prices could severely affect the country.

Gillis-Harry said fuel prices at retail stations may fluctuate and highlighted that petrol is nearing N1,000 per litre.

He urged the government to prioritize internal economic growth, referencing Trump’s tariff hike from five to 14 per cent as a reason to diversify income streams.

According to him, pump prices could drop as the cost of feedstock decreases.

“Fuel reduction should normally be expected because the cost of the feedstock is part of the cost of production. If the crude price reduces, it will affect the price. But we don’t know when the price cut can happen.”

Professor Emeritus Wumi Iledare, an energy expert, explained that price volatility is part of the oil business.

He agreed that the slump would reduce government earnings while also lowering fuel prices.

“In the short run, it is bad for every petroleum-dependent economy in terms of government access to revenue and pressure on foreign reserves.

“The crash, however, could lead to higher economic activities, reduce petroleum product prices, and lead to higher economic output because of high employment in the private sector.”

Professor Dayo Ayoade of the University of Lagos attributed the price drop to global market instability sparked by Trump, adding that recovery depends on restored investor confidence.

He lamented that Nigeria may resort to borrowing to fund its budget.

“Crude price crash is bad for Nigeria because our budget is fixed on certain prices, and if we don’t meet those prices, we won’t be able to fund the budget. We will have to go and borrow. Nigeria has over-borrowed; we are struggling with a lot of economic challenges based on huge debts and funding those debts.

“We should learn to rely on ourselves and focus on internal growth. We should use our big population to create prosperity. We should go back to the farm. People should not be hungry with the kind of land and weather God has blessed us with. We should look inwards,” he said.

On Sunday, crude refiners suggested that petrol prices could fall to N400 per litre if crude drops to $50 per barrel, but noted that the end of the naira-for-crude swap deal may prevent such a drop.

Meanwhile, the Federal Government expressed concern that Trump’s tariffs might adversely affect Nigeria’s economy.

Minister of Industry, Trade and Investment, Jumoke Oduwole, cautioned that the policy could significantly disrupt both oil and non-oil exports to the US, one of Nigeria’s major trade partners.

Credit: The Punch

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY1 day ago

BIG STORY1 day ago