BIG STORY

Court Dismisses Suit On Sale Of 9mobile

- /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 27

https://porscheclassy.com/wp-content/uploads/2019/04/9MOBILE-e1555568761332.jpg&description=Court Dismisses Suit On Sale Of 9mobile', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

- Share

- Tweet /home/porsch10/public_html/wp-content/plugins/mvp-social-buttons/mvp-social-buttons.php on line 69

https://porscheclassy.com/wp-content/uploads/2019/04/9MOBILE-e1555568761332.jpg&description=Court Dismisses Suit On Sale Of 9mobile', 'pinterestShare', 'width=750,height=350'); return false;" title="Pin This Post">

-

BIG STORY2 days ago

BIG STORY2 days agoUS Orders Review Of All Green Cards Issued To Migrants From 19 Countries, Exempts Nigeria [SEE FULL LIST]

-

BIG STORY4 days ago

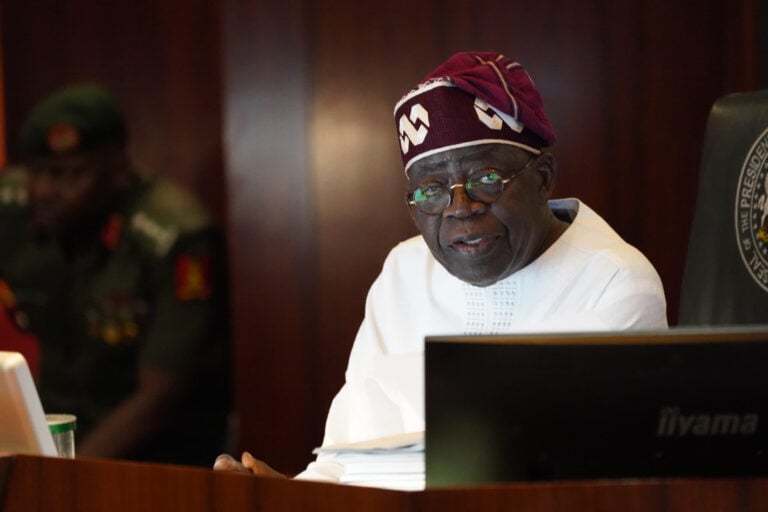

BIG STORY4 days agoBREAKING: Tinubu Nominates 3 Non-Career Ambassadors

-

BIG STORY4 days ago

BIG STORY4 days agoBREAKING: President Tinubu Declares Security Emergency, Orders 20,000 New Police Recruits

-

BIG STORY4 days ago

BIG STORY4 days ago2026 Appropriation Bill: Obasa Says Budget Fundamental To Sustaining Lagos’ Position As Africa’s Leading Economic Hub

-

BIG STORY2 days ago

BIG STORY2 days agoTrump To Permanently Pause Migration From All ‘Third World Countries’

-

BIG STORY3 days ago

BIG STORY3 days agoDrug Baron, Five Others Nabbed As NDLEA Uncovers N6.7bn Stash

-

BIG STORY4 days ago

BIG STORY4 days agoFG May Seize Dana Air Assets To Refund Passengers, Travel Agents — Aviation Minister Keyamo

-

BIG STORY3 days ago

BIG STORY3 days agoIGP Confirms Withdrawal Of 11,566 Police Officers Attached To VIPs