Amidst early gains from the recently launched twin policy on cashless economy, the Central Bank of Nigeria, CBN, has kick-started some key steps towards consolidating the policy measures.

The twin policy is anchored on the Naira redesign and establishment of new limits on cash withdrawal from banks, all geared towards effective monetary policy and security environment while taming corruption.

Meanwhile the apex bank has also indicated that the policy has recorded some achievements setting the base for the new reinforcements.

The key steps includes the commencement of a nationwide stakeholder engagement and sensitization to promote understanding of the cashless policy, particularly in rural areas, markets and underserved communities across the six geopolitical zones of the country.

The apex bank, in conjunction with Bankers Committee and Share Agents Network Expansion Facility, SANEF, is also strengthening the Agent Network Capacity by intensifying agent rollouts across the country (especially underserved locations) and enhance Agents’ ability to carry out a wider variety of financial services in addition to 12 Classified as Confidential cash-in and cash-out (electronic card distribution, wallet/account opening, BVN onboarding, bills payment, etc).

A geospatial map of available financial access points is also being completed and the apex bank said it shall be made public to inform all stakeholders of the locations of physical and electronic financial access points where they can process transactions electronically.

The CBN promised to continue to be flexible in its implementation of cashless policy and monitor its impact especially on vulnerable segments of the society but ensure the multiple advantages are achieved.

In response to the Naira redesign policy banks’ vaults have recorded about N190 billion inflow as Currency Outside Banks, COB, fell by 6.7 per cent month-on-month in November to N2.64 trillion from N2.83 trillion in November 2022.

The N2.64 trillion COB in November represents the lowest in 12 months since October 2021.

Further reflecting the impact of the CBN cashless policy, currency-in-circulation (CIC) similarly fell month-on-month (MoM) by 4.0 percent, to N3.16 trillion in November from N3.29 trillion.

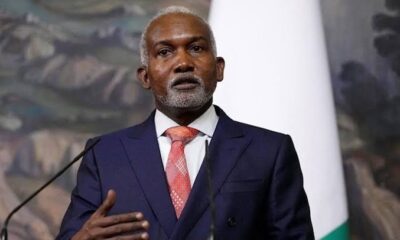

Recall that the CBN Governor, Mr. Godwin Emefiele, on October 26, announced the redesigning of the naira notes in denomination of N200, N500 and N1,000 in October, citing persisting concerns with the management of the current series of banknotes among other things.

Consequently, the CBN directed that bank customers must deposit the old notes by January 31st when they will cease to be legal tender, while the new notes were released into circulation on December 15th.

According to Emefiele, one of the challenges primarily include: significant hoarding of banknotes by members of the public, with statistics showing that over 80 percent of currency in circulation are outside the vaults of commercial banks.

He said as at the end of September 2022, available data at the CBN indicate that N2.73 trillion out of the N3.23 trillion currency in circulation was outside the vaults of commercial banks across the country.

Achievements of cashless policy

Meanwhile the CBN Deputy Governor, Financial System Stability, Mrs Aisha Ahmed, has reeled out the achievements of the cashless policy since its first phase in 2012 to date.

Addressing the national Assembly on the twin policies last week Ahmed stated: ‘‘The implementation of the cashless policy was a critical element that catalyzed the transformation being witnessed in the Nigerian financial and payments system.’’

She listed some of the key achievements to include: Expansion in financial access points (ATM, PoS, Agents and mCash); Proliferation of e-payment Platforms; Growth in electronic channels adoption; Enhancement financial inclusion; International Recognition of Nigeria’s Payment System & growth in vibrant fintech ecosystem; Positive impact on GDP; and Financial resilience of citizens during COVID.

On the revised cash withdrawal limit, she noted that the CBN is not unmindful of the concerns raised in response to the new limits and would remain flexible to make the necessary adjustments to ensure wider public acceptance of the policy.

This, according to her necessitated the upward reviewe of the cash withdrawal limits to N500,000 weekly for individuals (from N100,000) and N5,000,000 weekly for corporates (from N500,000).

Furthermore, the applicable charges above the limit have been reduced to 3% and 5% respectively. Mobile money agents who provide cash-in cash-out services in rural areas have also been recognized and provided for in the revised guidelines.

Justifications for the cash limits

The CBN has explained that it carried out in-depth analysis of over-the-counter intra-bank cash transactions over 12 months (November 2021- October 2022) to assess the impact of the policy on the generality of citizens.

The outcome showed that a significant value of cash transactions was below the maximum thresholds indicated under the extant cashless policy and were thus not subject to the cash processing charges. It also showed that 94.04% and 62.63% respectively of volume and value of cash transactions by individuals were below the threshold while 82.36% and 39.38% of the volume and value of cash transactions by corporates was below the threshold.

Other outcomes are as follows: Transactions at agent locations are also below the thresholds. For instance, 99% of cash withdrawals at agent locations are below N300,000, average cash out transaction size per individual is N18,000, whilst average cash withdrawals by agents is between N1,000,000 and N2,150,000.

The proliferation of financial access touch points and e-payment channels across urban and rural areas which presents citizens with ample alternative for financial transactions further justifies the nationwide implementation of the policy. 6,500 branches of banks and other financial institutions, 1.4million agent locations, 900,000 POS and 14,000 ATMs.

Meanwhile, Ahmed had also noted that the twin policies were in compliance with best practice. She stated: ‘‘The Policy is in line with the CBN’s quest to adopt international best practices and international conventions, especially in view of recent reputational damage with some Nigerians perpetuating advance fee fraud’’.

She added that the policies fall within the statutory responsibilities of the Central Bank, saying, ‘‘The CBN’s mandates and responsibilities under the CBN Act 2007 as amended empowers it to promote a sound and stable financial system and credible efficient payment system- Section 2d, Section 47 of the CBN Act and the policies were issued pursuant to these legal provisions. The actions are well within this mandate.’’

Misconceptions on the policies

Addressing the many misconceptions of the Naira Redesign and Cash-less Policy, Ahmed stated: ‘‘Currency denominations of N5, N10, N20, N50, and N100 remain legal tender, are unaffected by the Naira redesign policy and are available for use across the country including at markets in rural areas and informal sector of the economy.

‘‘There are currently no processing fees applied to cash deposits. Unlimited amounts can be deposited without charge, to enable seamless and unrestricted deposit of any notes affected by the currency redesign.

‘‘The processing fees on cash withdrawals are not new as these have been in place in Lagos, since 2012, and in five other Cash-less states and FCT, since July 2013.

‘‘The charge applies on the excess over the prescribed limit only not on the entire transaction amount. For instance, withdrawal of ₦550,000 by individual- fee is excess over N500,000 limit (i.e. ₦50,000x 3%= ₦1,500); Withdrawal of ₦6,000,000 by a corporate- fee is excess over N5,000,000 limit (i.e. ₦1,000,000 x 5%= ₦50,000).

‘‘The Policy does not prohibit cash transactions above the prescribed limits. Such transaction shall attract the processing fees to serve as incentive for account owners to embrace more efficient electronic payment channels.

‘‘The policy applies nationwide in recognition of the plethora of financial touch-points that are available in all the States of the Federation’’.

Benefits of cashless

CBN had listed the benefits of the implementation of full cashless policy to include:

· Building on the successes already recorded which have been highlighted in 3.0 above. Benefits include:

• Reduction of cost of cash management (processing, movement, security, destruction of old notes) which is often passed on indirectly to Nigerians including eliminating the physical risk of cash – robbery, kidnapping, terrorism!

• Promote Nigeria’s positive reputation for fighting money laundering and terrorist financing. Cash limits are recognized in Anti Money Laundering Laws due to its role in advancing these illegal activities.

• Reduction in incidences of crime – armed robbery, kidnapping, terrorism financing, advance fee fraud, graft, ransom payment and extortions. etc

• Deepening the Nigerian payment system through more innovation and cheaper costs

• Financial inclusion – the route to scaling financial inclusion is through electronic channels. Mobile phone penetration in Nigeria is 152m (according to NCC). EFINA survey shows that 81% of Nigerians excluded have mobile phones

• USSD helps to overcome the need for internet connectivity to smart phones

• Economic opportunities for small businesses & rural communities to facilitate trade and improve livelihoods, thereby boosting economic growth

• More effective transmission of monetary policies

• Overall growth, development and stability of the financial system

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY7 hours ago

BIG STORY7 hours ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago