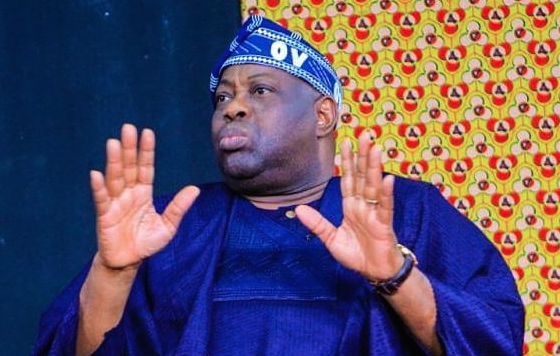

Dele Momodu, publisher of Ovation Magazine, says he regrets spending about N50 million to buy the presidential nomination form of the Peoples Democratic Party (PDP) in 2022.

Momodu spoke in a recent interview on Eden Oasis, published on Sunday.

The journalist and politician said the primary was heavily monetised, with a particular aspirant doling out $30,000 to each of the 774 delegates who voted during the election.

The politician stated that he would not vie for any party’s presidential ticket unless he is adopted as a consensus candidate.

“Experience is the best teacher. I have come to realise that there are powers that you can describe as principalities that control Nigeria,” he said.

“Unless a major political party decides to adopt me — where you have a consensus of people who say Dele Momodu is best suited to change and to lead Nigeria. Then I will consider it.

“But if I have to pick my money to buy a presidential nomination form of about N100 million… I spent about N50 million to buy the form for the last one.

“N50 million would have bought me a property. It was a waste. I didn’t get even one vote because everything was monetised.

“One of the candidates paid as much as $30,000 per delegate, and we had 774 delegates.

“So, how do you want to compete with them? They have stolen the country blind and are doing all kinds of deals to make money, especially those in the oil-rich areas.

“It is not easy. You can’t compete with them. That’s why they insult Nigerians anyhow because of the amount of money available to them in raw cash. There’s no country where people buy raw cash like Nigeria.

“The bulk of their money is not in any bank. So, they are not traceable to any bank. So, they have the money. If today you say to some politicians that you need $500 million to become a president, they will find it.

“So, people like us, where will I start from?”

Momodu was one of the presidential hopefuls of the PDP at the time. He did not secure any votes during the exercise.

Atiku Abubakar clinched the presidential ticket with 371 votes to beat his closest challenger, Nyesom Wike, now minister of the federal capital territory (FCT), who polled 237 votes.

Abubakar was defeated by Bola Tinubu of the All Progressives Congress (APC) in the 2023 presidential election.

Bukola Saraki, former senate president, scored 70 votes; Bala Mohammed, Bauchi governor, got 20 votes; Udom Emmanuel, former governor of Akwa Ibom, secured 38 votes; while Pius Anyim, former secretary to the government of the federation, polled 14 votes.

Sam Ohuabunwa, a businessman, alongside Momodu and Ayodele Fayose, the former governor of Ekiti, received zero votes.

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY14 hours ago

BIG STORY14 hours ago

BIG STORY14 hours ago

BIG STORY14 hours ago

BIG STORY3 days ago

BIG STORY3 days ago