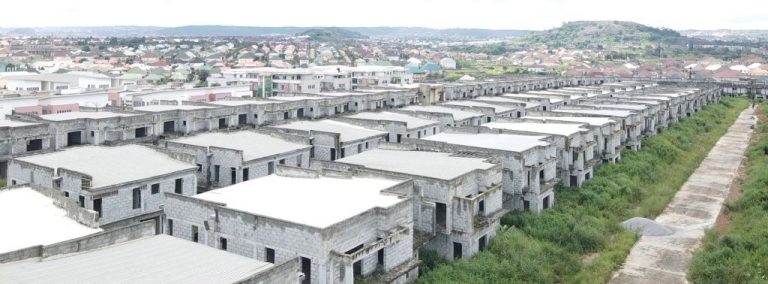

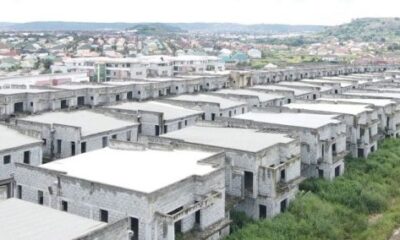

Justice Jude Onwuegbuzie, on Monday, 2 December 2024, delivered a ruling on the final forfeiture of an estate in Abuja measuring 150,500 square metres, containing 753 units of duplexes and other apartments.

This marks the single largest asset recovery by the Economic and Financial Crimes Commission (EFCC) since its establishment in 2003.

The estate is located on Plot 109 Cadastral Zone C09, Lokogoma District, Abuja.

The forfeiture of the property to the federal government by a former senior government official follows the EFCC’s mandate and policy to ensure that individuals involved in corrupt and fraudulent activities do not benefit from the proceeds of their crimes.

In this case, the Commission relied on Section 17 of the Advance Fee Fraud and Other Fraud-Related Offences Act No. 14, 2006, and Section 44 (2) B of the Constitution of the Federal Republic of Nigeria (1999) to pursue its case.

Ruling on the Commission’s application for final forfeiture, Justice Onwuegbuzie stated that the respondent failed to demonstrate why the property should not be forfeited, declaring that, “which has been reasonably suspected to have been acquired with proceeds of unlawful activities, the property is hereby finally forfeited to the federal government.”

The path to this final forfeiture was paved by an interim forfeiture order, secured before the same judge on November 1, 2024.

The government official responsible for the fraudulent construction of the estate is under investigation by the EFCC.

The forfeiture of this asset is a crucial method of depriving the suspect of the proceeds of their criminal activities.

The legal basis for the forfeiture is found in Part 2, Section 7 of the EFCC Establishment Act, which grants the EFCC the power to “cause investigations to be conducted as to whether any person, corporate body or organization has committed any offence under this Act or other law relating to economic and financial crimes and cause investigations to be conducted into the properties of any person if it appears to the Commission that the person’s lifestyle and extent of the properties are not justified by his source of income.”

The Commission’s Executive Chairman, Mr. Ola Olukoyede, has consistently emphasized the importance of asset recovery in the fight against corruption, economic, and financial crimes, describing it as a significant deterrent against corrupt and fraudulent individuals.

Speaking before the House of Representatives Committee on Anti-Corruption recently, he stated, “If you understand the intricacies involved in financial crimes investigation and prosecution you will discover that to recover one billion naira is war. So, I told my people that the moment we start investigation we must also start asset tracing because asset recovery is pivotal in the anti-corruption fight; and one of the potent instruments that you can deploy as an anti-corruption agency for an effective fight is asset tracing and recovery. If you allow the corrupt or those that you are investigating to have access to the proceeds of their crime, they will fight you with it. So one of the ways to weaken them is to deprive them of the proceeds of their crime. So, our modus operandi has changed simultaneously. The moment we begin investigation, we begin asset tracing. That was what helped us to make our recoveries.”

The EFCC Establishment Act places significant emphasis on asset recovery.

Under Section 24 of the Act, “whenever the assets and properties of any person arrested under the Act are attached, the Commission shall apply to the court for an interim forfeiture and where a person is arrested for an offence under the Act, the Commission shall immediately trace and attach all the assets and properties of the person acquired as a result of such economic and financial crime and shall thereafter cause to be obtained an interim attachment order from the Court. And where the assets or properties of any person arrested for an offence under the Act has been seized or any assets or property has been seized by the Commission under the Act, the Commission shall cause an application to be made to the Court for an interim order forfeiting the property concerned to the Federal Government and the court shall, if satisfied that there is prima facie evidence that the property concerned is liable to forfeiture, make an interim order forfeiting the property to the Federal Government, which the Commission would usually escalate to earn a final forfeiture.”

This procedure was duly followed in this case.

The recovery of this asset represents a milestone in the operations of the EFCC and serves as indisputable proof of President Bola Ahmed Tinubu’s commitment to the anti-corruption fight.

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY4 hours ago

BIG STORY4 hours ago