BIG STORY

National Assembly Considering Bill Seeking To Increase VAT From 7.5% To 10% By 2025

-

BIG STORY4 days ago

BIG STORY4 days agoBREAKING: Governor Sanwo-Olu Accepts Hosting Rights For BON Awards, Lauds Organisers’ Guinness World Record Bid

-

BIG STORY1 day ago

BIG STORY1 day agoJUST IN: FG Declares Friday, Sept 5, Public Holiday For Eid-ul-Mawlid — Interior Minister Urges Prayers For Peace, Unity

-

BIG STORY4 days ago

BIG STORY4 days agoFirstbank’s ₦1 Trillion Digital Loan Disbursement Milestone And The New Era Of Inclusive Lending In Nigeria

-

BIG STORY1 day ago

BIG STORY1 day agoFidelity, Sterling, Other Tier-2 Banks Under Pressure As CBN’s 2026 Recapitalisation Deadline Looms — SBM Report

-

BIG STORY4 days ago

BIG STORY4 days agoJUST IN: Phyna’s Sister Ruth Otabor Dies After Truck Accident

-

BIG STORY3 days ago

BIG STORY3 days agoBREAKING: Finnish Court Sentences Simon Ekpa To Six Years In Prison For Terrorism Crimes

-

BIG STORY2 days ago

BIG STORY2 days agoLeave Before Visa Expires Or We’ll Remove You — UK Warns Foreign Students

-

BIG STORY3 days ago

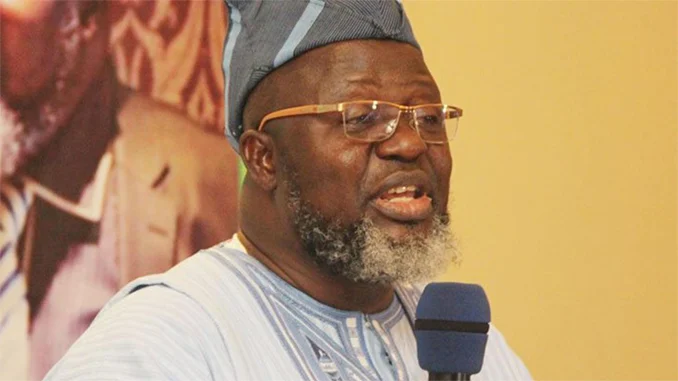

BIG STORY3 days agoNRC MD Kayode Opeifa Apologises For Remarks Against Journalist During Train Derailment Coverage