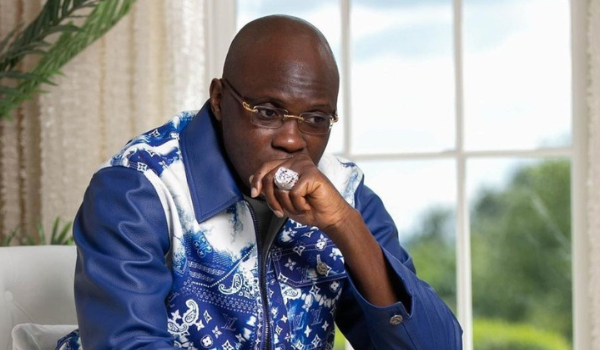

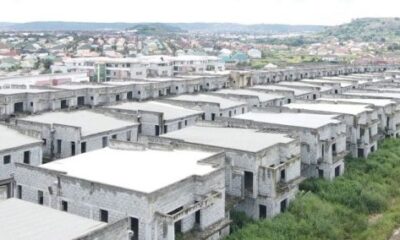

Court papers filed by the Economic and Financial Crimes Commission (EFCC) have linked the immediate-past Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, to a massive property in Abuja, consisting of 753 duplexes and other apartments located in the Cadastral Zone area of the capital city.

On Monday, the EFCC announced the recovery of the property from an unnamed former top government official, calling it the largest single recovery the agency had made in its history of fighting corruption since its establishment in 2003.

The recovery followed a ruling on December 2, 2024, by Justice Jude Onwuegbuzie of the FCT High Court in Apo.

Court documents obtained by our correspondent on Tuesday detail how the EFCC connected Emefiele to the massive estate, which spans 150,500 square meters and is identified as Plot 109, Cadastral Zone C09, Lokogoma District, Abuja.

Emefiele is currently facing prosecution by the EFCC in three separate cases before different judges.

Before Justice Hamza Mu’azu, he is on trial for procurement fraud, forgery of former President Muhammadu Buhari’s signature, and other charges.

Before Justice Rahman Oshodi at the Special Offences Court in Ikeja, Lagos, Emefiele is charged with fraud involving $4.5bn and N2.8bn.

Additionally, Emefiele faces charges before Justice Maryann Anenih of the FCT High Court in Abuja for allegedly approving the printing of N684.5m worth of notes at the cost of N18.96bn.

According to the EFCC’s documents, Emefiele is accused of carrying out a “monumental fraud” while serving as CBN governor, with the assistance of his cronies, to acquire several properties, including the estate.

“The commission, whilst investigating the alleged monumental fraud carried out by the immediate past Governor of the CBN and his cronies, traced and discovered several properties reasonably suspected to have been acquired and/or developed with proceeds of unlawful activities,” the EFCC stated.

The agency further alleged that Emefiele negotiated kickbacks in exchange for allocating foreign exchange to companies in desperate need of funds for legitimate business activities.

The EFCC also claimed that Emefiele received kickbacks from contractors awarded contracts by the Central Bank of Nigeria.

The investigation revealed that Emefiele collaborated with several cronies, including one Ifeanyi Omeke, who “ran several errands for him, including the purchase and perfection of title documents for properties located in highbrow areas of Lagos and Abuja.”

The EFCC said the documents for the Abuja property were recovered during a search of Omeke’s office, and investigators located the property on September 17, 2024, “with the assistance of a surveyor from the Abuja Geographical Information Systems, using search results and coordinates.”

The agency noted that the property has been abandoned since June 2023, following the arrest of the former CBN governor.

In October, the EFCC arrested Emefiele shortly after he regained his freedom from the Department of State Services (DSS), which had previously detained him.

The EFCC further disclosed that the massive property, allegedly acquired through cronies, was originally intended for a mass housing development. The investigation revealed that Emefiele used three companies to pay a total of N2.2bn for the property.

It said the seller “received the aggregate sum of N2,200,000,000.00” and that the three companies involved in the payment were “enmeshed in criminal maneuvering of layering proceeds of illegal activities of Mr. Godwin Emefiele.”

The EFCC alleged that one company paid N900m, a second company paid N700m, and a third company paid N600m, bringing the total to N2.2bn.

It further stated that the directors of the companies were arrested, and their statements were voluntarily obtained during the investigation.

“The funds used in the acquisition of the property highlighted in Schedule A to this application are not legitimate earnings of Godwin Emefiele but funds acquired through illegal and unlawful activities,” an EFCC investigator stated in the affidavit filed in court.

The EFCC added that the court had, on November 1, 2024, made an order for the temporary forfeiture of the property after evaluating the facts before it. The commission requested that the judge now order the permanent forfeiture of the property to the Federal Government, as no one had contested the facts, despite the interim forfeiture order being published (in The Punch) on November 6, 2024.

The court agreed to the EFCC’s request, and the property has now been permanently forfeited to the Federal Government.

Attempts to reach Emefiele’s legal team for comment were unsuccessful. One of his lawyers, Matthew Burkaa (SAN), did not respond to calls or text messages seeking Emefiele’s side of the story.

‘Why EFCC Concealed Property Owner’s Identity’

EFCC spokesperson Dele Oyewale defended the agency’s decision not to reveal the identity of the property’s owner.

Responding to public criticism about the concealment, Oyewale explained, “The allegation of a cover-up of the identity of the promoters of the estate stands logic on the head in the sense that the proceedings for the forfeiture of the Estate were in line with Section 17 of the Advance Fee Fraud Act, which is a civil proceeding that allows for action-in-rem rather than action-in-personam.”

He added that the civil proceeding focused on the property itself, not an individual, especially since the property was “unclaimed.” He emphasized that since the investigation was ongoing, revealing the identities of suspects not directly linked to title documents would be unprofessional.

“The substantive criminal investigation on the matter continues. It will be unprofessional of the EFCC to go to town by mentioning names of individuals whose identities were not directly linked to any title document of the properties,” Oyewale concluded.

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY17 hours ago

BIG STORY17 hours ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY22 hours ago

BIG STORY22 hours ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY17 hours ago

BIG STORY17 hours ago

BIG STORY2 days ago

BIG STORY2 days ago