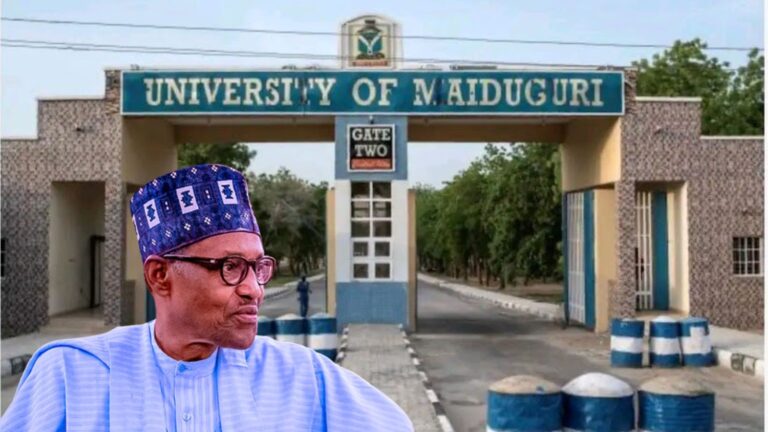

President Bola Tinubu has given approval to rename the University of Maiduguri in Borno State as Muhammadu Buhari University.

May we now adopt the University of the Maduguri as the Muhammadu Buhari University, Tinubu announced at the end of a special Federal Executive Council session held to honour Buhari at the Aso Rock Villa, Abuja, on Thursday.

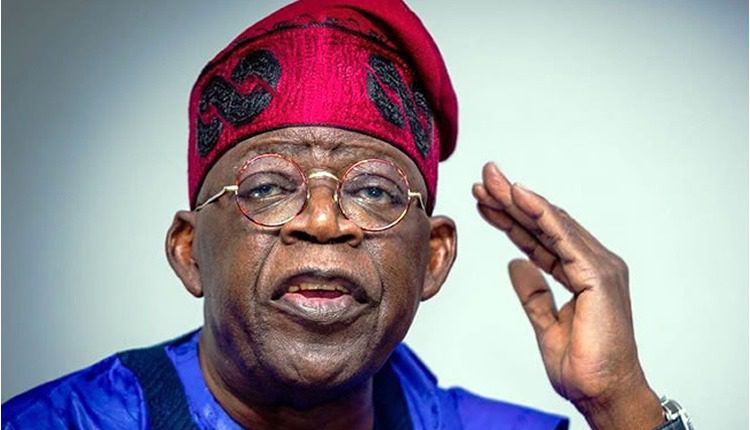

Earlier, the President offered a heartfelt tribute to Buhari, portraying him as a good man, a decent man, an honourable man, whose legacy of discipline, patriotism, and strong moral values would be remembered for generations.

Tinubu acknowledged that although Buhari had imperfections, his steadfast dedication to serving the nation distinguished him.

President Buhari was not a perfect man, no leader is, but he was, in every sense of the word, a good man, a decent man, an honourable man.

His record will be debated, as all legacies are, but the character he brought to public life, the moral force he carried, the incorruptible standard he represented, will not be forgotten.

His was a life lived in full service to Nigeria, and in fidelity to God, he added.

Looking back at Buhari’s leadership and long career in both military and civil service, Tinubu highlighted his humility, modesty, and resistance to the temptations of power.

He stood, always, ramrod straight; unmoved by the temptation of power, unseduced by applause and unafraid of the loneliness that often visits those who do what is right, rather than what is popular.

His was a quiet courage, a righteousness that never announced itself. His patriotism was lived more in action than in words.

Tinubu also reflected on their political partnership, which led to the historic 2015 elections, marking Nigeria’s first peaceful transition of power between political parties.

We stood together, he and I. Alongside others drawn from across the political spectrum, regions and tongues, we formed an alliance that enabled Nigeria to experience its first true democratic transfer of power from one ruling party to another.

When he was sworn in as our party’s first elected President, he led with restraint, governed with dignity, and bore the burdens of leadership without complaint, he said.

The President admired Buhari’s life after leaving office, saying he chose to live quietly in Daura rather than influence politics from behind the scenes.

When his tenure ended, he returned to Daura; not to command from the shadows or to hold court, but to live as he always had, never seeking to impose his will but content to let others carry the nation forward.

Even in death, he maintained the serenity that defined him in life: not a sigh, not a groan, just a quiet submission to the will of God. Such was the man Nigeria has lost. Such was the man for whom our nation now mourns, he added.

Tinubu expressed gratitude to the Inter-Ministerial Committee and Katsina State Governor, Dikko Radda, for putting together a state funeral in less than 48 hours, calling it a profound honour to lead the burial ceremony in Daura.

He ended his tribute with a final message: Mai Gaskiya, the People’s General, the Farmer President, your duty is done. May Almighty Allah forgive his shortcomings and grant him Aljannah Firdaus. May his life continue to inspire generations of Nigerians to serve with courage, conviction, and selflessness. President Buhari, thank you. Nigeria will remember you.

Buhari passed away on Sunday, July 13, at the age of 82.

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY15 hours ago

BIG STORY15 hours ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago