The International Monetary Fund (IMF) says its advice on foreign exchange (FX) rate and subsidy removal was necessary for Nigeria’s macroeconomic stability.

The Washington-based institution reiterated its stance on its policy recommendations to Nigeria in an email to Premium Times on Wednesday.

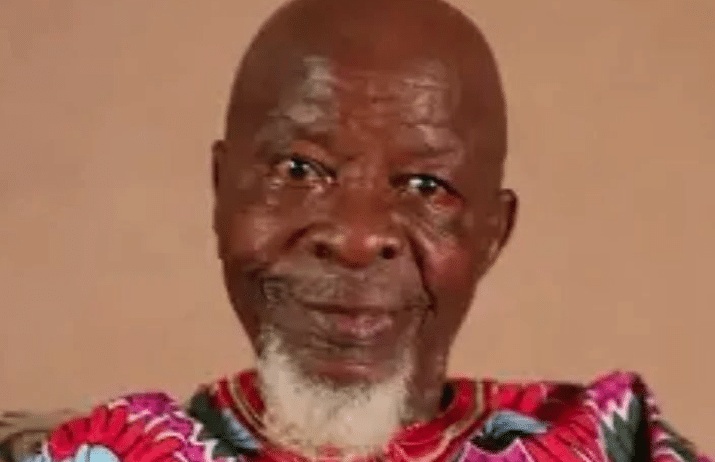

Abebe Selassie, director of the African department at the IMF, had applauded the economic reforms implemented by President Bola Tinubu’s administration during a press briefing at the just concluded IMF/World Bank meetings in Washington DC., United States.

Selassie said the IMF has consistently advocated for Nigeria’s investment in infrastructure, health, and education; describing the removal of the subsidy as a step which represents a more effective use of public resources.

He said the move would unlock the economy’s vast potential to become more dynamic, attract investments, and drive growth.

Selassie had also said the Nigerian government should direct the savings from petrol subsidy removal to support vulnerable households amid the country’s economic hardship.

However, on October 25, local media reported that the IMF had denied being involved in the removal of the petrol subsidy.

The Nigeria Labour Congress (NLC), on October 28, criticised the international “lender for its denial” of responsibility regarding the Nigerian government’s recent removal of the subsidy.

Speaking on the matter on Wednesday, the IMF said it assessed Nigeria’s petrol subsidy and foreign exchange rate policies prior to the recent reforms but did not consider it “cost-effective”.

“Regarding the petrol subsidy, based on our research and international experience, we do not see this as the most cost-effective way of providing relief to Nigerian citizens,” the lender said.

“This is mainly because the petrol subsidy benefits not just low-income households that need government support, but also high-income and wealthy Nigerians who do not need this financial support from the government.

“Moreover, there is evidence that a share of the subsidised petrol was smuggled to neighbouring countries, where petrol prices were much higher. This means that the petrol subsidy benefitted not only Nigerians but also the citizens of neighbouring countries.

“Thus, removing the petrol subsidy should free resources that the government can allocate to other priority spending items, including social protection, health and education spending, and infrastructure investments.”

The IMF said the fixed exchange rate policy in operations before the recent reforms, was equally not sustainable.

“We have also assessed the viability of the fixed exchange rate regime that Nigeria pursued until mid-2023,” IMF added.

“At the time, not all dollar demand from Nigerians was being met at the official exchange rate. Instead, many Nigerians had to turn to the parallel market and pay a premium of around 60 percent to acquire dollars.

“This means that until mid-2023 some Nigerians were able to purchase dollars at the official rate of around N460 to the US dollar. But many others, at the same time, could only purchase dollars at the parallel market rate of around N750 to the US dollar.

“While some people were able to transact at a subsidized rate, many others had to pay a much higher price. This also put pressures on the CBN’s reserves and was not sustainable.

“By allowing the naira to be determined by market conditions, everyone now has access to US dollars at the same price.”

On whether the criticisms could lead to the lender’s withdrawal from the country, IMF said its advice was to all its member countries, as summarised in its annual report on each country.

“We stand by our advice, though it’s important to underscore that individual pieces of that advice cannot be viewed in isolation,” the multilateral added.

“Our advice is a comprehensive policy package where all elements are linked to each other. That package seeks to ensure macroeconomic stability and raise living standards in a sustainable fashion.

“Importantly, our advice on petrol subsidies and the exchange rate, is set in a larger, comprehensive policy mix that also includes scaling up social transfers to provide relief to Nigerians who are already suffering from a cost-of-living crisis or who are impacted by policy reforms.”

The IMF also said governments “listen to advice from many corners and then decide on the best course forward”.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY3 days ago

BIG STORY3 days ago