BIG STORY

2016 FG Budget: Best For Kwara In 16years —- Governor Ahmed

-

BIG STORY5 days ago

BIG STORY5 days agoJUST IN: Lagos State Government Seals Cubana Chief Priest’s Lagos Restaurant “The Donald’s” Over Noise Pollution

-

BIG STORY4 days ago

BIG STORY4 days agoLagos Taskforce Arrests 54 Touts And Illegal Ticketers In Ongoing Crackdown

-

BIG STORY5 days ago

BIG STORY5 days agoSanwo-Olu: Steadily Entrenching A Safer Lagos By Adeshina Oyetayo

-

BIG STORY4 days ago

BIG STORY4 days agoJUST IN: NNPC Releases Pump Prices Of Dangote Petrol, To Sell N999 In FCT, N950 In Lagos

-

BIG STORY2 days ago

BIG STORY2 days agoPolice Arrest “Boko Haram’s Weapon Instructor”, Recover Machine Gun, Other Ammunition [PHOTOS]

-

BIG STORY2 days ago

BIG STORY2 days agoJUST IN: Yahaya Bello Has Honoured EFCC Invitation — Media Office

-

BIG STORY3 days ago

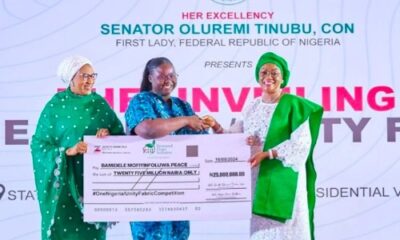

BIG STORY3 days agoFirst Lady Remi Tinubu Unveils Fabric To Promote “One Nigeria,” Gifts Designer N25m

-

BIG STORY1 day ago

BIG STORY1 day agoOsun Mortuary Attendants, 5 Others Arrested For Selling Human Parts, Water Used To Bathe Corpses