Africa’s Global Bank, the United Bank for Africa (UBA) Plc on Friday, 23rd of May, marked this year’s Africa day on, with fanfare. The event which was celebrated across the banks 20 African subsidiaries, including New York, UK, France and Dubai, culminated into a mini carnival at the corporate head office in Marina, Lagos as it witnessed a rich culture of African people on display.

The bank said the event was aimed at encouraging Africans home and abroad to be patriotic and embrace their culture.

It was all colour and glitz as a troupe of dancers representing Nigeria, Ghana, Zambia, Côte d’Ivoire, Senegal, Zimbabwe, among other African countries, entertained the audience from the entrance of the building to its doorways through to the Tony Elumelu Amphitheatre Hall. Their overall performances exuded good vibes and earned them ovation from all.

Noting that Africa has unarguably positioned herself as the second largest continent in the world with its rich cultural heritage, the bank said the continent remains the only one in the world that was evidently bequeathed with the most colourful and distinctively diverse culture appreciated across the globe.

From her aesthetic art works, ethnic costumes, expressive dances, mind-blowing plethora of languages, amazing dishes, tourists attractions, and wildlife among others, Africa is seen as a world power that is yet to explore.

It is, therefore, to proudly and powerfully project her cultural heritage that UBA hosted the event in Lagos an to commemorate this year’s Africa Day. It said that part of its aim was for dignitaries to map out lasting solutions to persisting challenges in the continent.

Themed, “Educate an African Fit for the 21st Century: Building Resilient Education Systems for Increased Access to Inclusive, Lifelong, Quality, and Relevant Learning in Africa,” for us at UBA, it only reinforces our belief and passion for education as exemplified in our foundations National Essay Competition where winners who emerge are given scholarships through school.

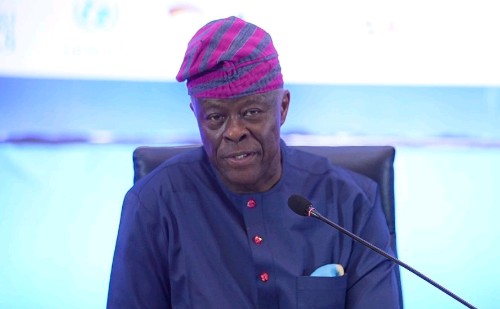

According to the Group Managing Director, United Bank for Africa, Oliver Alawuba, “We are in 20 African countries and four countries outside Africa. Our focus has always been on not only driving investments into Africa but also to empower Africa’s youth by honing the critical thinking prowess of our youth as well as groom them for leadership roles across the continent.

Alawuba said UBA aspires to develop and grow in the world, adding that unity is critical and very important in Africa hence the emphasis on how to change the narrative. “Unity is critical and very important for the future of Africa, we need to remain united to achieve our aspirations and the youth are critical to that growth”, he said.

Consequently, as one of Africa’s leading financial services institutions, with a pan-African footprint spanning 20 African countries and globally in the US, UK, the United Arab Emirates and France, UBA says it’s fully committed to unifying Africa and empowering youths for the future. It also continues to lead the narrative focused on the development, growth, and unity of Africa

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY19 hours ago

BIG STORY19 hours ago