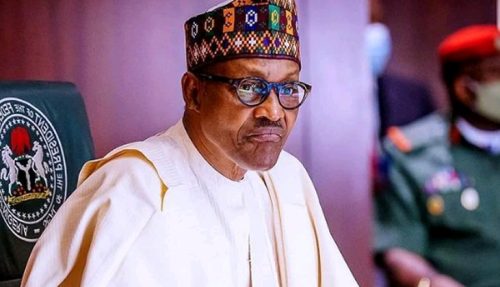

President Bola Tinubu has emphasized that there is no turning back on the tax reforms bills.

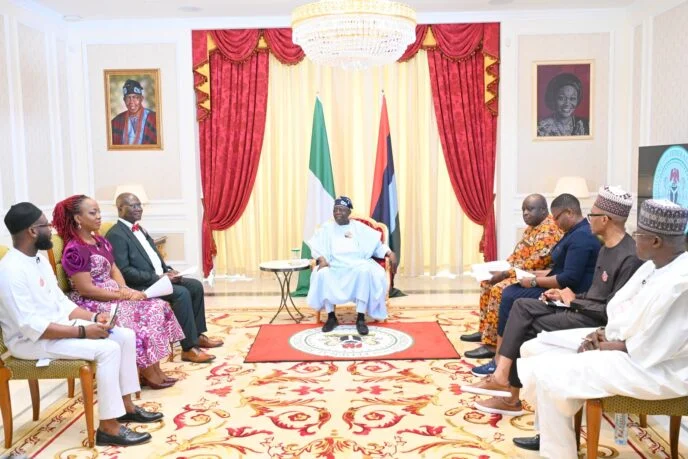

Tinubu, speaking during a media chat in Lagos on Monday, explained that the tax reforms were driven by the need to remove colonial-era assumptions from the nation’s tax system.

The Presidential Media Chat, Tinubu’s first, was broadcast on the Nigerian Television Authority Monday night.

The tax reforms have sparked debate across the country, prompting the House of Representatives to suspend the discussion on the bills, originally scheduled for December 3, following mounting pressure from the governors of the 19 northern states.

The planned debate was canceled after 73 northern lawmakers opposed the bills.

While the reforms have gained support in the South as a means of ensuring more equitable resource distribution, stakeholders argue that resistance from the North stems from concerns over marginalization and economic harm.

Borno State Governor, Babagana Zulum, was quoted in an interview with BBC as saying, “Why the rush? The Petroleum Industry Bill took almost 20 years before it was finally passed. But this tax reform bill is being transmitted and receiving legislative attention within a week. It should be treated carefully and with caution so that even after our exit, our children will reap its benefits.”

“We condemn these bills sent to the National Assembly. They will drag the North backwards and also affect the South East, South West, and some South-Western states like Oyo, Osun, Ekiti, and Ondo.”

The PUNCH reported that on September 3, 2024 President Bola Tinubu transmitted four tax reforms bills to the National Assembly for consideration following the recommendations of the Taiwo Oyedele-led Presidential Committee on Fiscal and Tax Reforms.

The bills include the Nigeria Tax Bill 2024, which aims to provide the fiscal framework for taxation in the country, and the Tax Administration Bill, which will provide a clear and concise legal framework for all taxes in the country and reduce disputes.

Others are the Nigeria Revenue Service Establishment Bill, expected to repeal the Federal Inland Revenue Service Act and establish the Nigeria Revenue Service as well as the Joint Revenue Board Establishment Bill, which will create a tax tribunal and a tax ombudsman.

On October 29, 2024, the Northern Governors Forum, the umbrella body comprising the 19 governors of the region, kicked against the bill, particularly the Value Added Tax-sharing template.

At a gathering in Kaduna, the governors directed federal lawmakers from their respective states to vote against the bills when they came up for debate in both chambers of the National Assembly.

Two days later, the National Economic Council presided over by Vice President Kashim Shettima advised the Federal Government to withdraw the bills to create room for broader consultations among critical stakeholders, a counsel turned down by the President in a statement by his spokesman, Bayo Onanuga.

But the President stressed that tax reforms was pro-poor and aimed at widening the tax net, noting that it was typical for tax reforms to be accompanied by outcries.

He said, “Tax reform is here to say. We cannot just continue to do what we were doing yesteryears in today’s economy. We cannot retool this economy with the old broken tools. The essence of the tax reform is to eliminate colonial-based assumptions in our tax environment. Every tax situation without outcry is not a tax.

“You cannot satisfy uniformly the larger community of tax evaders. This tax reform is pro-poor; the vulnerable are not to pay taxes. All we are asking for is to widen the tax net and bake the cake larger so that we can share a larger meal.

“They will still ask for this consultation no matter how long I delay it. The hallmark of a good leader is the ability to do what you have to do at the time it has to be done. That is my philosophy.”

Questioned about the economic hardship following the subsidy removal, the President said he had no regret as it had become necessary.

Tinubu said removing petrol subsidy was in a bid to save generations to come, noting that the country was already spending its future while giving freebies to neighbouring countries.

He also knocked calls for the phased removal of subsidies, saying the nation was headed for financial disaster.

With the subsidy removal, he said what was imperative was for Nigerians to manage within available resources and shun unnecessary expenses.

“What contingency? We were spending our future. We were spending our generations’ fortunes; we were not investing. We were just deceiving ourselves. That reform is necessary. I could see the smugglers fighting back; that doesn’t affect me. It affects smuggling. Why should you have expenditures that you don’t have revenue for? I don’t want to question people who have acquired limousine kind of vehicles on the road. We should teach management in all our programmes. We have to manage our resources within our means,” Tinubu stated.

“There is no way that you give out fuel and allow all the neighbouring countries as Father Christmas. I don’t have any regret whatsoever in removing the subsidy. It is necessary. We cannot spend our future generations’ investments upfront.

“Phased removal is part of unnecessary fear. No matter how you cut it, you still have to meet the bills. So cut your coat strictly to your size. Management is the issue and we have no choice but to pull the hand brakes, otherwise, we are headed for slippery slopes and in such financial disaster, not just for us, but for our children and grandchildren. Where is the pathway for prosperity?”

The President added that he was not ready to shrink his cabinet, saying all his appointees were adding value.

Declaring that Nigeria was a large country that needed a lot of hands, he said his appointees had specific assignments and what was imperative was efficiency and effectiveness.

Tinubu said his plan in the 2025 budget proposal to reduce inflation from 34 per cent to 15 per cent would be realised by boosting local production and reducing imports.

“If one produces more for consumption locally, stop imports, give a reasonable level of funding and assistance, the low interest rate to farmers, improve the security as you see in the budget so that they can return to their farms and produce more food, encourage the procurement and manufacturing of drugs in Nigeria, we have what it takes.

“Talk to Professor (Ali) Pate, he is doing an excellent job trying to encourage. All I need to do is put the incentive in place in order for them to harness what is possible in Nigeria. It is about time we do all of those. Bring the cost of governance down,” he explained.

On the recent stampedes, Tinubu blamed organisers of the various events in Ibadan, Abuja and Okija, where a total of 67 people, including 35 children, died in their rush for palliatives.

His comments follow a wave of stampedes as people scampered for food items made available by charitable groups and individuals.

In Okija, Anambra State, what was meant to be a Christmas palliative distribution on Saturday turned tragic when 22 persons lost their lives, with several others injured, during an early morning stampede.

The same day in Abuja, another tragedy struck when 10 persons died during an annual Christmas food-sharing event at Holy Trinity Catholic Church, Maitama.

These incidents followed Wednesday’s stampede at the Islamic High School, Basorun, in Ibadan, Oyo State, where several children lost their lives during a holiday funfair celebration, with others rushed to the University College Hospital for medical attention.

“To me, I see this as a very grave error on the part of the organisers,” he said. “Are we looking at it from the organisers point of view or from the goodwill gesture of the people trying to give what they have as extra?

“Sadly, people are not very well organised, we just have to be more disciplined in our society. Condolences to those who lost family members, but it is good to give. I have been giving out food stuff and commodities, including envelopes in Bourdillion for the past 25 years; I have never experienced this kind of incident because we are organised and prone to discipline.

“If you don’t have enough to give, don’t attempt to give or publicise it. Every society has food banks and hungry people. They are organised; they take tokens to be in line and take turns to collect. It is unfortunate. It is reflected at our bus stops, we don’t want to queue, so we rush to board vehicles. We continue to learn from our mistakes.”

On fighting corruption, Tinubu said his efforts in this regard included the removal of subsidy, which he said ended stopped smuggling of the nation’s petroleum resources.

The President said he believed in people having more access to legitimate income as a way to tackle corruption, noting that with increased earnings, allocation to states and local governments had increased.

He also stated that anti-corruption agencies continued to plug loopholes for corruption, noting that the recent discovery of hundreds of duplexes reportedly owned by a former Governor of the Central Bank of Nigeria, Godwin Emefiele, was evidence of his government’s corruption fight.

Tinubu also mentioned the Student Loan as a means to prevent people from subscribing to corruption to fund their education.

While noting that the government cannot eliminate corruption fully, he stated that it had drastically reduced corrupt practices, adding that the increase in minimum wage was also a way to tackle corruption.

The President said, “Corruption in all ramifications is bad. First of all, pay enough attention to the causes. Why are the people corrupt? The lack of social amenities; the lack of needs in some areas; lack of funding for their children’s education. There are so many anti-corruption mechanisms that you can put in place that will help the people not to be corrupt. Pay them good living wages.

“I have moved from N35,000 to N70,000, to me that is anti-corruption. If I can earn more, I have given more money to the states and local governments. I have been transparent with my earnings. Every month, there is a publication as to how much this country is making.

“We got the man who had 735 houses. You don’t know how long it has started. He had fantastic infrastructure; he had a row of houses but we got it. That is anti-corruption too. We got it for the public. The structure, ability to stem corruption is part of the instrument of the EFCC, that is why they are discovering all sorts of inefficiencies in the system. Block all the loopholes where anybody can just game the system.

“Part of the anti-corruption is removal of subsidy. It is very difficult to eliminate but you reduce it to the barest minimum.

“Meet the people’s needs; help them with the education of their children. Our students’ loan is part of anti-corruption. No parent should lament how to encourage their children in university education. It is working for the larger part of the population.”

Asked about how to stem the high price of food items, Tinubu said he believed in increasing agricultural production, not price control.

He said government would continue to work hard to increase supply to the market such that the nation had enough to feed itself and export.

“I don’t believe in price control,” he said.

Credit: The Punch

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY5 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY4 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY17 hours ago

BIG STORY17 hours ago