Given the grimness and prevalence of mental health issues across the country, the Speaker of the Lagos State House of Assembly, RT. Hon. Mudashiru Obasa has advocated inter-sectoral collaboration with the assembly and collective responsibility by agencies, individuals, and institutions.

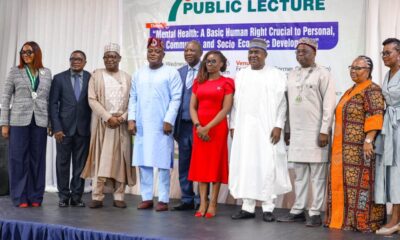

Speaking in his capacity as chairman at the Seventh Public Lecture of the Board of Fellows, Pharmaceutical Society of Nigeria (PSN), held Tuesday, July 2, 2025, at the Festival Hotel, Amuwo-Odofin, Lagos, Obasa described the theme, Mental Health: A Basic Human Right Crucial to Personal, Community, and Socio-Economic Development, as timely and globally relevant.

He opined, “We live in times where the mental health of individuals is increasingly becoming a matter of public concern because globally, there is a rising incidence of mental health disorders, and unfortunately, Nigeria is not exempted.”

The Lagos Speaker reckoned that mental health is crucial to personal and community development because, “It is the bedrock upon which personal growth and achievements are built. For our nation to thrive, we need citizens who are mentally sound and can contribute meaningfully to national development.

“Socio-economic development is intertwined with mental health. A nation with a high burden of mental health disorders will undoubtedly suffer a decline in productivity, a decrease in the quality of life, and a strain on health resources.”

Conversely, he said that a community with a high prevalence of mental health disorders is not only destabilised but also lacks progress. Therefore, he continued, “It is important that we take collective responsibility to ensure that our communities are mentally healthy. As a nation, we must pay keen attention to mental health and integrate it into our public health policies.”

Obasa recalled that the issue of mental health is very dear to him, which encouraged the enactment of the Lagos State Mental Health Service Law of 2018 during his first term as Speaker. The law provides for the protection and care of individuals with mental health conditions and substance abuse, stresses the rights of patients, including the right to treatment close to their domicile, and the same rights as physically ill persons. It also focuses on integrating mental health services into primary healthcare, providing comprehensive coverage, and fostering intersectoral collaboration.

However, Obasa noted that professional bodies like the PSN are not collaborating enough with lawmakers to drive change. “We must advocate for policies that promote mental health care, combat stigma, and support initiatives to enhance mental well-being. Together, we can ensure that mental health is recognized as a basic human right essential to personal, community, and socio-economic development,” he concluded.

Brig. Gen. Buba Marwa (Rtd.), Chairman/CEO of the National Drug Law Enforcement Agency (NDLEA) and special guest of honour, linked the rise in mental health issues to fake drugs and substance abuse. He described mental health as a neglected aspect of public health and called for increased awareness and sensitisation programs by the PSN.

In his address, Pharm. Uche Akpakama, chairman, Board of Fellows, Pharmaceutical Society of Nigeria, said, “It is documented that more than a quarter of the Nigerian population has mental health issues, exacerbated by the current socio-economic situations, including extreme poverty, internal displacement, insecurity, and unemployment.” Akpakama said he hoped that the public lecture would address the current state of mental health in Nigeria, the role of pharmacists, other health professionals, and proffer strategies for promoting mental health awareness.

The keynote speaker, Dr Gbonjubola Abiri, a Consultant Psychiatrist and CEO of Redi-Med Consulting, a medical consultancy firm, said having established the grimness of the situation, “the drive now is to ensure mental health promotion and the prevention of mental health disorders in the general population, while also ensuring that persons with mental disorders are given the best attention to manage their health so that they can live their best lives despite their conditions.”

Pharm. Gbenga Falabi, chairman of the planning committee, declared that the annual lecture serves as a platform for knowledge-sharing and developing strategies to promote mental health awareness. “Today’s insights will enhance our understanding of mental health’s critical role in personal, community, and socio-economic development,” he said.

BIG STORY2 days ago

BIG STORY2 days ago

BIG STORY6 hours ago

BIG STORY6 hours ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY1 day ago

BIG STORY8 hours ago

BIG STORY8 hours ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY3 days ago

BIG STORY2 days ago

BIG STORY2 days ago